With COVID-19 vaccinations underway and a new stimulus/relief package in the works, investors have begun to worry about inflation. The concern has manifested itself in a recent rise in longer-dated bond yields.

Higher Rates Reduce Asset Value

There is some math involved but the simple short of it is that higher rates reduce the value of assets.

We learn in Finance 101 that the value of any asset is the present value of all future cash flows. The flows that are the furthest out in time are the most sensitive to rising rates. As a result, the high flyer disrupter stocks that will not be profitable for years took a big hit this past week.

The hot ARK Innovation ETF which invests in “disruptors” like Tesla and Roku, lost 10% of its value last week.

The FAANGs were also under pressure this week as well. While the FAANGs have current profits, much of their perceived prospects lie in the future.

With disruptors, new issues like SPACs, and mega-cap NASDAQ stocks rallying so hard in 2020 and into 2021, their valuations were in the stratosphere. At the same time that the darling tech stocks were falling, the old economy sectors like financials, energy, and industrials moved higher. Investors sold the high valuation stocks and bought the low valuation pockets of the market.

Whether the re-allocation will continue will depend on how persistent inflation expectations will remain in the minds of investors. While input prices for commodities are rising, hours worked and wages have remained flat-ish.

The Return of Inflation: Not a Foregone Conclusion

Even though a return of inflation is being talked about as a foregone conclusion, I am skeptical. The rapid decline in demand resulting from the pandemic caused supply chains to contract significantly. Farmers, miners, manufacturers, and service providers all cut back expecting a prolonged slump.

However, the vaccine, along with prospects for expanded fiscal stimulus, brought demand back and new orders created a supply-demand imbalance. Prices for all sorts of commodities, including semiconductors, agricultural products, and crude oil, moved higher.

John Dizard in the Financial Times described the situation as akin to “The Beer Distribution Game” developed at MIT in the 1950s to simulate the dynamics of a production-distribution system. Over-reaction by participants can, under certain circumstances, create big swings in supply and demand. In time, production is restored and supply comes up to meet demand.

If this dynamic plays out, inflation pressures will ease. We will need more data points before we can really say inflation is back.

Stock Bubbles?

With prices of well-publicized assets like Bitcoin and “disruptor” stocks experiencing a meteoric rise, many worry that these represent bubbles. The timeline of market history is littered with bubbles. While bubbles are often talked about they aren’t as common as market imagination makes them out to be.

One problem with understanding bubbles is that they are difficult to define. I have heard long-time money manager and bubble historian, Jeremy Grantham, describe a bubble as prices greater than two standard deviations from the mean. It’s hard to be precise. It’s somewhat “you know one when you see one”.

If we assume Bitcoin is in a bubble, it is now the biggest bubble in history. It recently eclipsed arguably the most famous bubble, the Dutch Tulip Bubble of 1636-1637.

Following the Tulip Bubble in order of declining magnitude, you had:

- The 1720 South Sea Bubble

- The 1720 French Mississippi Bubble

- The Japanese Real Estate Bubble that took place in the 1980s

- The Dot-Com bubble of 1999-2000.

Bubbles burst and prices can tumble, relentlessly. When the Roaring Twenties ended with the Great Crash of 1929, the Dow Jones Industrials fell 90% by 1932.

After the Hunt brothers tried to corner the silver market in 1980, the metal’s price dropped 66% in two months.

Often it takes a long time for prices to recover to the lofty levels from which they fell. The Japanese stock market has yet to reach its 1989 peak.

Whether Bubbles or Inflation, Stay Focused on Long-Term Investing Plans

Investors need to be careful when trying to ride an investment rocket-ship. If one wants to play in this treacherous pool, it’s important to play it small, do not deviate from your long-term investment plan, and take profits. There is nothing worse than round-tripping a big gain.

Thanks for reading.

The Pendragon Capital Management Team

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

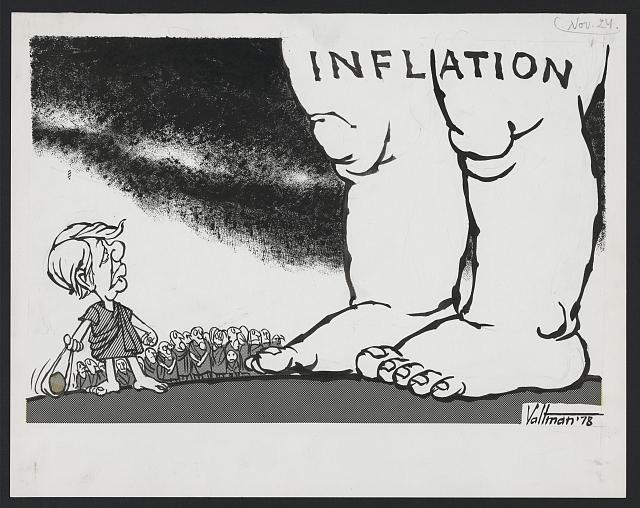

Image credit: Valtman, Edmund S., Artist. Inflation / Valtman ’78. United States, 1978. Photograph. https://www.loc.gov/item/2010646073/.