As a serious investor, you regularly weigh risk and return as you consider what to invest in, what to divest, and how to react to market news and attempts to manage economic forces. In this article, you’ll get a taste of the market’s response to pain, higher short-term interest rates, and falling bond prices.

>> To subscribe to this monthly newsletter, click on Subscribe!

Evaluating Risk and Return in the Market

The Federal Reserve and Inflation

The big news this week was not that the Federal Reserve raised the Fed Funds Rate by 0.75%. That was widely expected. What did surprise the market was the Fed’s forecast for how much they believe they need to raise rates to bring inflation down to their 2% target.

The Markets and the Word “Pain”

Adding to the market angst was Chairman Powell’s resolute stance that there will be pain and higher unemployment to vanquish inflation. “Pain” is not a word the markets wanted to hear. Stocks and bonds sold off and interest rates rose sharply on the shorter end of the curve and more moderately on the long end.

Expectations for 3rd Quarter Results

Not only do the markets need to deal with the Fed but the 3rd quarter is about to close and we will see how inflation, interest rates, and negative sentiment will affect corporate revenues and profits.

Companies did reasonably well in the 2nd quarter. According to FactSet, 76% of companies in the S&P500 posted earnings that exceeded estimates. With oil prices high, it is no surprise that energy stocks led with year-over-year profit growth of a remarkable 293%.

Can companies manage to pull off decent earnings in the 3rd quarter? There are a lot of headwinds.

A Strong US Dollar

In addition to the ones mentioned already, the US dollar has been strong against major currencies. About 30% of S&P500 companies’ revenues are earned abroad. When the US dollar is strong, these non-US revenues are translated back into fewer dollars.

Are 3rd Quarter Estimates Too High?

Analysts have lowered 3rd quarter earnings estimates by about 5.5% since June 30th. About 20% of the 500 companies have issued 3rd quarter guidance. Of the 105, 65 have guided lower and 40 issued higher guidance than the 2nd quarter. Many market observers think that estimates are too high. We’ll have to see.

The risk seems to be the downside. The forward price-to-earnings ratio for the S&P500 is just over 16 times. This is below the 5-year average of 18.6. Stocks are down 21% this year. Needless to say, there is uncertainty and a lot for investors to deal with.

Has Potential Bad News Been Sufficiently Priced Into the Market?

However, the market is a discounting mechanism. At 16 times earnings, has the market priced in the potential bad news? If it has and profits are better than expected or even stable, the market could rally. If the 3rd quarter earnings season is a bust, there will be “pain” indeed.

Higher Short-Term Interest Rates, Falling Bond Prices & Risk Return

Shorter-term interest rates have risen dramatically.

- Inflation and the Fed’s moves to combat it have pushed 1-year US Treasury notes from almost zero to over 4%.

- The 10-year US Treasury note now yields 3.51%. It began the year at 1.52%.

The flip side of rising rates is falling bond prices. The iShares 7-10 year Treasury ETF has dropped almost 14% in 2022 while the iShares Investment Grade Corporate Bond ETF is down 18% YTD. Bonds have not been a source of protection.

Balanced funds that were 60% stocks and 40% bonds were solid performers when stocks were rising and interest rates were falling. With rates rising, that is no longer the case.

At the beginning of the year, the risk-return for bonds, given the 10-year rate was just 1.52% was not attractive. It is not surprising that bonds have not worked. There was almost no way to win. Plus, with such low rates, bond prices were highly sensitive to rising rates.

Attractive Short-Term Bonds

Now, conditions have changed. At 4%, short-term notes look attractive. US Treasuries are not subject to state and local income taxes which is a bonus. If we get a mild recession and defaults remain low, investment-grade corporate bonds that yield 5% also would have a favorable risk-return. The bond market is positioning as if rates have to go higher.

There is a scenario, perhaps with less of a probability, that inflation may show a surprise moderation. If that does play out, the Fed might change course and slow the rate hikes. If the economic bears who are forecasting a deeper recession are correct, the Fed might even have to cut rates.

In these two scenarios, bonds could provide capital gains in addition to giving investors some yield.

Quality Companies With Low P/Es and Significant Dividend Yields

There are similar situations in stocks. At the recent peak in prices, price-to-earnings ratios for many stocks were at nose-bleed levels with no dividend. It’s hard to win. Invariably something will happen like an earnings miss or a hike in interest rates.

Today, there are shares of quality companies where the price has fallen such that the P/Es are low and dividend yields are significant. If you buy a quality stock with a 4% yield, you don’t need a lot of capital appreciation to receive, over time, a good total return.

>> See Always Look for Investing Opportunities

Don’t Lose Sight of Risk and Return When Investing

Ultimately, investing in the market is all about risk and returns.

Please don’t hesitate to reach out with questions.

Thanks for reading.

>> Download the September 2022 Newsletter <<

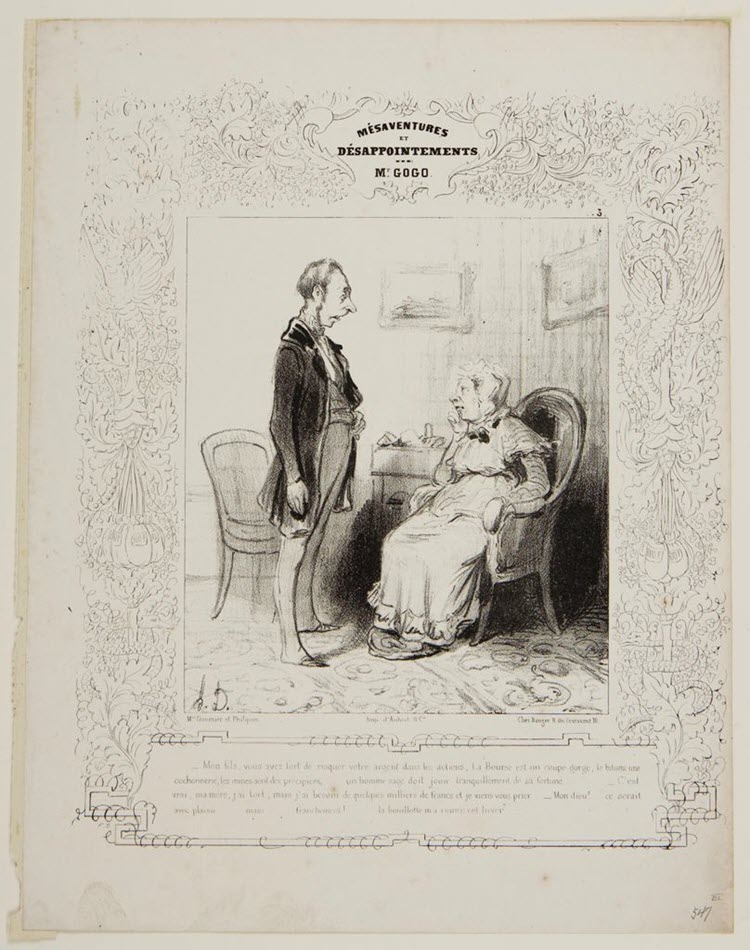

Image Credit: Honoré-Victorin Daumier, French (Marseille, France 1808-1879 Valmondois, France), “My son, you are right to risk your money . . .” from Mésaventures et Désappointements de Mr. Gogo

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.