Have you considered the role of bonds in your portfolio?

The BrokerageSelect Newsletter summarizes current market trends while highlighting the kind of innovative out-of-the-box thinking that Pendragon Capital Management specializes in. This issue will explore bonds and rethinking the role they have traditionally played in a portfolio.

Perspective on the Stock Market: October 2020

Resilient and In Suspended Animation

The stock market has remained resilient, hovering near highs. In some respects, the markets have been held in suspended animation waiting for the election, for Congress to pass another relief bill, and for a Coronavirus vaccine.

Mega-cap Growth Names Remain Market Leaders

While we have seen some strength in the value and out of favor sectors like financials, energy, and industrials, the mega-cap growth names have been, for the most part, still the leaders.

The economic data has been generally good. Of course, there are the haves and, very unfortunately the have nots but in aggregate both corporate profits and broad economic measures have exceeded expectations.

Inflation Has Ticked Up

Some data has been showing signs that inflation has ticked up. The break-even inflation rate reflected in Treasury TIPs is 1.7%, back to where it was before COVID hit. The break-even rate had fallen to 0.50% in March.

Whether or not inflation can sustain upward momentum is a topic of great debate.

Some Supply Chain Disruptions While Oil Sees No Upward Price Pressure

Supply chain disruptions have caused some increase in food and intermediate goods prices. One big commodity that has not seen upward price pressure is oil. COVID has dampened demand and there has been some increased supply coming from Libya. It’s hard to see sustained inflation without oil participating.

Similarly, it’s unlikely that interest rates can move much higher as long as the Federal Reserve is willing to buy along the whole curve.

New Market Trends Aren’t Necessarily Underway

What all this amounts to is that despite the long-awaited small moves in value stocks, inflation, and interest rates we have seen over the past weeks, this does not necessarily mean new trends are underway. It is very much a wait and see and, until proved otherwise, conditions in the markets are likely to remain the same.

On the topic of the election, despite the various opinions of market commentators, history has shown that it is very difficult to know how stocks will react to election results. The occupant of the White House is only one of many factors that influence stock prices.

Rethinking the Role of Bonds in a Portfolio

The current environment is forcing investors to re-think the role of bonds in their portfolios. The reasons for this are two-fold:

- The very low rates in the market today

- Concerns over credit quality of both corporate and municipal bonds.

After a 40-year bull market, bonds were not simply a source of stability to portfolios. They were actually a significant contributor to capital gains.

In some sense one could say bonds, especially post-2008 where central banks actively pushed rates lower, over-performed and the balanced portfolio overearned.

Low-Interest Rates Mean Low Bond Yield

Investors tend to subject themselves to recency bias. We take the most recent data and project the same trend outward. This ignores factors like mean-reversion and valuation. With interest rates so low, the yield will not provide much in the way of income and how likely will bonds provide a source of capital gains which would come only if already low rates go even lower?

How Likely Are Even Lower Interest Rates in the US?

Of course, rates could go lower. Some rates in Europe are negative. However, what’s the probability negative rates happen in the US?

Investors need to access this in order to determine whether capital gains are in the cards for bonds.

COVID-related Stress on Corporate Sectors

In addition to the challenge of low rates, COVID has placed significant stress on several corporate sectors in the economy like entertainment and hospitality and on the municipal issues where tax revenues have dried up.

The Traditional Portfolio Role of Bonds as Source of Stability

If investors are careful to include only high-quality issues in portfolios, bonds can still play their traditional role as a source of stability. Even if the income is low, a US Treasury is highly likely to return your principal no matter the economic environment.

Do You Need to Adjust Your Bond Fund Expectations Down?

It’s another issue whether the income is sufficient to keep ahead of inflation.

It’s important for investors to look at their portfolios in the context of the current and future, not the past. This might mean that investors need to adjust downward their expectations for their bond funds.

This is especially important with projected income in long-term financial plans. If bonds and bond funds will return significantly lower returns going forward, and one uses historical performance in plans, investors may well be overestimating their future income.

Thanks for reading.

The Pendragon Capital Management Team

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

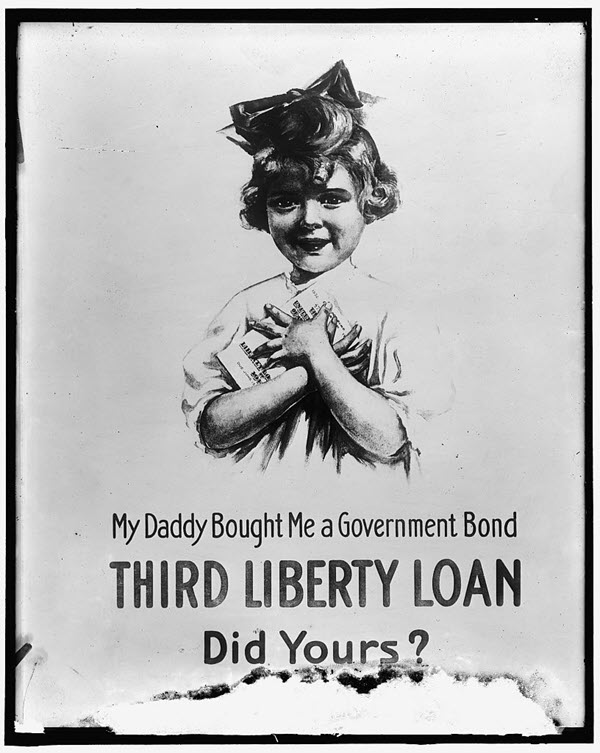

Image Credit: Harris & Ewing, photographer. Liberty Bond Poster. , None. [Between 1910 and 1920] Photograph. https://www.loc.gov/item/2016855064/.