2023 was a difficult year for investors but as we take a breath and after assessing 2023, it can best be summarized as The Bard wrote, “All’s well that ends well.”

Bears Controlled the 2023 Narrative

In 2023, the Bears controlled the narrative – inflation and interest rates were going to move unstoppably higher, recession was inevitable, political turmoil would unravel markets, and investors now have an alternative with a newfound love of money markets.

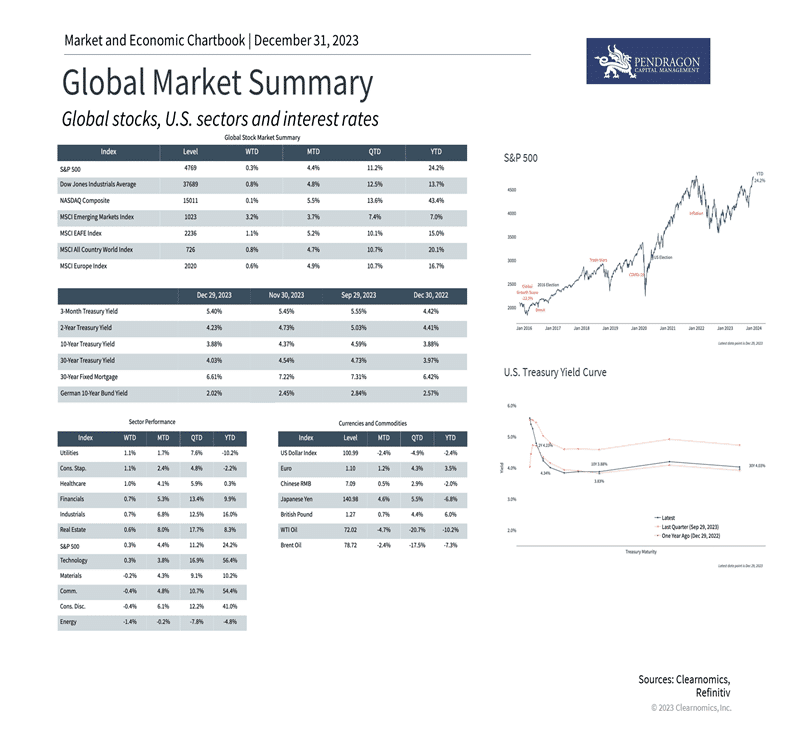

However, as we see from the accompanying slide below, equities moved HIGHER, and inflation and interest rates after rising sharply, moved back LOWER. The economy was strong, political deals were made to keep the government open, and while flows to money markets were incredible, when stocks stabilized, money did flow back to equities.

Large Cap Stocks Dominated 2023

In 2023, large-cap stocks, led by Technology and the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), dominated the action. The heavy market weighting of the M7 in the S&P 500 helped the index post a 26% total return. In contrast, if you gave an equal weighting to all the stocks in the S&P500, the return would have been a much lower 14%. As you can see from the chart below, the difference between the returns of the big companies versus the smaller companies is not new.

Many market strategists are calling for the trend to change with the 493 other stocks in the S&P500 catching up to the Magnificent 7. Many also are predicting that small-cap stocks could outperform large-caps. The analysts could be right, but the “burden of proof” is high given recent history.

Small Caps Might Surprise

Having said that different market sectors tend to move around on the “Best Performing List”. Small-caps and Emerging Markets have been so discounted in recent years that they might surprise.

Small-caps were the last best-performing asset class in 2020. You have to go back to 2017 to have Emerging Markets as the best performer.

Emerging Markets & Big NASDAQ Stocks

Interestingly, Emerging Markets were #2 in 2020. If the Fed eases rates and financial conditions, perhaps the 2024 environment would be similar enough to 2020, when the Fed worked to offset the impact of COVID, to get Small-caps and Emerging markets going up. Again, we need to realize that what has been working is likely to keep working so while small stocks and Emerging Markets are a contrarian play worth exploring, the big NASDAQ stocks are still the horses to beat.

The Fed and Interest Rates

Speaking of the Fed and interest rates, I don’t think anyone would have thought that the 10-year Treasury would bear an interest rate at the end of 2023 unchanged from that at the beginning.

The surprise was driven by the fact that inflation has cooled off. CPI and PPI declined rapidly after the sharp rise post-Ukraine/Russia conflict and COVID disruptions. The PPI has declined to levels we had before the Pandemic.

Other 2024 Challenge: the US Election

As we move from a difficult 2023 climate for investors we will have other challenges in 2024. Of course, most challenges are yet to be known but one that will be cluttering the airwaves is the US election. Despite all the talk from the 24/7 media, according to Birinyi Associates,

“Since 1928 there have been 24 Presidential elections and the S&P500 has risen 75% of the time.”

They go on to say that when there has been a change in the party in power, the market has been positive 4 times and negative 4 times. One of those negative years was 2008 which coincided with the great Financial Crisis so we could discount that year.

When you compare election-year stock market performance to non-election years, you find that the returns are lower in election years but still nicely positive.

Elections have consequences but their impact on the markets is much less. Investors should not be looking at a one-year timeframe anyway so an election year is just another year in what should be a long-term investment and financial journey.

Strong Stock and Bond Market Rallies in Q4 2023

Both the stock market and the bond market had strong rallies in the 4th quarter of 2023 and ended the year in overbought territory. The markets do not go up in straight lines and there is a process of up-moves followed by retracements and back-filling.

The US stock market could easily have a pullback in January. Market pull-backs are common occurrences. They do not mean that stocks will go into a bear market or give up all of the recent gains. You’ll notice corrections that have occurred since 1980.

It does appear that we are in a bull market that began in 2023. If this is the case and until proven otherwise, a pull-back in January would be a buying opportunity.

After Assessing 2023, Here’s Advice for 2024 Investing

The markets are a journey and decisions are made along the way. It’s pointless to make broad predictions about a year ahead. What we will do is what we always do.

That is, we continually assess the investment environment and invest where the risk and return relationship seems best for our clients. We do our best to keep clients on track toward their financial plans and goals.

We wish everyone a happy, healthy, and prosperous new year. Don’t hesitate to reach out with questions.

Thanks for reading!

>> Download the Newsletter (includes more graphs) <<

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.

Copyright Information

Copyright (c) 2023 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete, and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results.

Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property.

All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.