What would you say to resolutions that simply require attention at the beginning of the year to provide you with value? That’s what you’ll find with the 9 financial resolutions detailed below.

Unlike traditional New Year resolutions that often wind up abandoned before January’s even over, these aren’t too time-consuming, complicated, or unpleasant to stick with. You’ll see benefits that will last you far into the future.

Furthermore, these financial resolutions are relevant whether you’re just getting started or already a seasoned investor. They’re based on the premise that you can’t forecast the market. You can, however, adopt healthy financial habits.

Here’s how.

Embrace these 9 Financial Resolutions in January and Throughout the Year

The key to healthy financial habits is embracing a financial plan and committing to address the following 9 resolutions at least once a year. I’m proposing January given the focus on starting afresh and resolving to do differently.

1 – Review Your Financial Plan

First is to review your financial plan, and make sure it’s on target based on the past year’s events, and what you anticipate for the coming year. Look at your allocations and confirm that they are consistent with your financial goals, needs, and risk tolerance. If they aren’t, make adjustments. What about your goals and needs? If they’ve changed, you’ll want to revise your plan accordingly.

Once you’ve reviewed your plan, stick with it. Don’t let emotions get in the way and lead you in the wrong direction. If you don’t trust your emotions or worry that you don’t have the discipline, work with a financial advisor.

If you don’t have a financial plan, create one. Essentially, a financial plan has three parts. It details your current money situation, identifies financial goals, and describes how to achieve those goals.

When you work with a financial planner or investment advisor, the financial plan will be your first priority.

Your Current Money Situation

Here, you tally your various financial assets – your checking and savings accounts, mutual funds, investments, etc.

Do the same for your liabilities – amounts owed, credit card debt, mortgage, student loans, lines of credit you have used, etc.

Detail your monthly income and expenditures (e.g., utilities, food, gasoline, mortgage payments, etc.) so you can create a family budget and understand how much you have leftover for saving and investing.

By the way, if you haven’t, be sure to set money aside for an Emergency Fund. This represents enough money to cover three to six months’ worth of expenses in case the unexpected happens.

Your Financial Goals

Financial goals can be short-term, such as planning for an exotic weekend getaway vacation, as well as long-term such as buying a house, paying for college, and planning for retirement.

These goals require significant amounts of money to achieve. Given time and planning, you will be able to do so.

How to Achieve Your Financial Goals

The third part of your plan describes what approach or strategy you will follow to achieve your financial goals based on your current money situation. This section will be unique to you and your family’s personal situation.

Furthermore, it addresses your level of risk tolerance. Generally, the greater your time horizon, the more risk you can tolerate. If you plan to retire next month, you’ll prefer less risk than if you were to do so thirty years from now.

Seek Professional Advice

These topics can be frustrating and complicated. Working with a financial planner or investment advisor can take the complexity and emotion out of the process and ensure that you get it done.

2 – Review Your Monthly Investment Fund Allocations

The most effective way to have money available to invest is to regularly and consistently set an amount aside in a separate cash account. That way, you can’t apply those funds to your day-to-day expenses. Rather, they are specifically available for your investment decisions.

As part of your New Year financial resolutions, be sure to review that monthly allocation amount. Can you increase it?

3 – Review Your Family’s Budget for Savings Opportunities

Look at the family’s budget for opportunities to save and invest. Saving and investing go hand in hand. It can be difficult to find the money to do both, so the best thing to do is review your budget with an eye for areas in which you can reduce spending.

As with resolution #1, here, too, a financial planner or investment advisor can help. If you don’t yet have a household budget, create one! Documenting your spending makes you more conscious of your spending. With greater awareness comes more opportunity to analyze patterns and identify savings.

4 – Assess Your Credit Card Debt

Assess the state of your own credit card debt and the interest you are paying on it. Can you pay that debt off? Can you obtain a lower interest rate?

In the third quarter of 2020, the average credit card debt per U.S. household was $7849, and while that number has dropped in comparison to past years, reducing it further represents a significant opportunity for savings.

5 – Are Your Documents in Order?

The beginning of the year is a good time to go through your important documents to ensure that everything is in order.

- Do your various insurances – property, life, auto, etc. – offer proper coverage?

- Do you need to update your will or living will?

- Have you identified healthcare proxies?

- What about a power of attorney should you become incapacitated?

6 – Fund Your IRA Before 4/15

Even though taxes aren’t due until April, the beginning of the new year is an ideal time to prepare and plan, starting with your retirement plan. Prepare to fund your IRA or your retirement plan if you’re self-employed before tax day.

7 – Make sure your passwords are secure and organized

There’s no getting around it. With so much of value stored digitally, it is critical for you to review your passwords and make sure none is compromised. Both Google and Firefox will alert you of data breaches your logins are part of so you can address them.

And, then, make sure your proxy knows how to access your passwords.

8 – Do a ‘Spring’ Cleaning and Make Donations

With all that new year momentum, now’s a perfect time to go through a spring cleaning with two goals in mind:

Consolidate Paper Records

Go through paper records to get rid of what’s no longer necessary. If you aren’t sure how long to keep things around, check out How long should you keep important documents? which recommends:

- Permanently store tax returns and your major financial documents

- Keep for 3-7 years documents that support your tax returns

- Hold onto for 1 year your monthly bank and credit card statements and pay stubs

- Retain utility bills for 1 month

Whatever you don’t keep, consider shredding securely to protect your privacy and identity.

Reduce Stuff

Look around you with an eye to reducing how much stuff you have. Not only can you do good by donating to those who don’t have as much as you, but you can also benefit from the donation on your taxes.

Be sure to obtain a receipt, though.

9 – Become More Green, Including in Your Investments

Last and not least, look around you for ways to become more green and earth-friendly. Can you recycle regularly? Is composting a possibility? Can you conserve energy and electricity? Can you walk or bicycle rather than drive? What about an electric or hybrid car rather than a gas-powered one? Is there a green power provider near you?

>> Here is Columbia University’s commitment to sustainability

If being green matters intensely to you, consider investing in sustainability.

Here at Pendragon Capital Management, you will find the Climate Impact Portfolio with investments in companies that make products or provide services that reduce carbon emissions and improve the planet’s environment.

>> Read How to Commit Financially to Sustainability

Are You Ready to Commit to These 9 Financial Resolutions This New Year?

Thanks for reading,

Ian Green and the Pendragon Capital Management Team

Subscribe to Pendragon's Newsletter

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

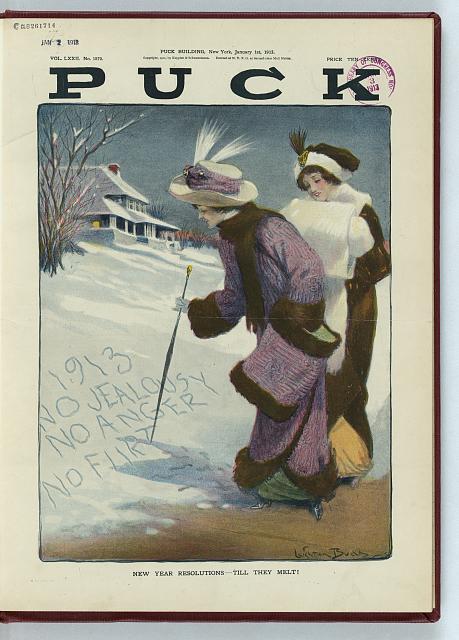

Image credit: Budd, L. (1913) New Year resolutions – till they melt! / Leighton Budd. , 1913. N.Y.: Published by Keppler & Schwarzmann, Puck Building, January 1. [Photograph] Retrieved from the Library of Congress, https://www.loc.gov/item/2011649414/.