As we say good-bye to 2020, despite all the turmoil and pain, the markets proved to be resilient beyond most people’s imagination.

Below, you’ll find the January 2021 BrokerageSelect Newsletter which summarizes current market trends while highlighting the kind of innovative out-of-the-box thinking that Pendragon Capital Management specializes in.

Markets resilient beyond most people’s imagination

While debate should be had about the effectiveness and fairness of its distribution, there is little doubt that the massive monetary and fiscal government response gave a tremendous lift to financial assets.

At first, the rally off the bottom was led by the FAANGs.

Then, as vaccines were approved, the rally broadened out to include not only beaten down travel-related stocks but also economically sensitive shares of industrials, financials, and energy.

Now we are in earnings season waiting for the results from the 4th quarter of 2020.

4th Quarter 2020 Earnings Season

The set up going into earnings is not great. Stocks across the board have run up, potentially pricing in a lot of future good news.

Case in point are the financial stocks which had explosive up moves in November and December. When the big banks reported last week, their stock prices dropped.

I’m not saying the rally is over. Rather that investors need to be careful when buying stocks after big moves into events like Earnings Season.

It would be very reasonable for stocks to have a cooling-off period as The Street assesses how much of the opening-up prospects are already reflected in stock prices. Many stocks are higher than they were before COVID hit.

Wall Street is comfortable with Janet Yellen as Treasury Secretary

Wall Street seems comfortable with President Biden’s choice of Janet Yellen as Treasury Secretary. She’s a known quantity and is generally viewed as even-keeled.

Many think of her as an easy-money economist but I’m not convinced. She did raise rates while she was Chair of the Federal Reserve. With her respected counterpart, Jay Powell at the Fed, it looks like accommodative monetary policy will stay for a prolonged time.

This should be a tailwind for stock prices.

Back and forth over the size and scope of Biden’s Relief Package

As the new Congress convenes a lot of back and forth will happen over the size and scope of Biden’s relief package. The initial $1.9 trillion proposal is likely to be reduced. This too could impact the markets.

The economy, despite the vaccine optimism, is still a ways away from returning to normal.

Ulta-low interest rates a major force in driving asset prices higher

The ultra-low level of interest rates that have been around since global central banks initiated quantitative easing has been a major force in driving asset prices higher. This is especially the case for the prices of companies with future prospects but no current earnings.

Like zero-coupon bonds with payouts only at maturity, speculative companies have no positive cash flows until way into the future. The mathematics of discounting cash flows dictate that moves in interest rates impact these assets much more than regular coupon bonds and stocks that pay steady or high dividends.

This is one significant reason we see meteoric rises in the likes of the electric vehicle companies, new e-commerce firms, and to a fair extent, the FAANGs.

Will a rise in interest rates derail the rally?

If rate declines helped fuel the speculation, will a rise in interest rates derail the rally? It’s dangerous to make predictions based on one metric as there are so many factors that go into asset pricing.

Having said that, all things being equal, a rise in rates could very well cause a reset in the way the market views these stocks.

COVID has caused supply disruptions

COVID caused supply disruptions across the economy. It will take time for firms to increase the supply of goods and services. Initially, demand will rise faster than supply.

We are already starting to see a rise in goods prices from semiconductors to corn. Inflation levels as implied from 10-year Treasury inflation-protected bonds went from 1.74% on January 1, 2020, to 0.50% at the bottom in March. They now sit at 2.10%.

While the Fed has firmly anchored short-term rates near zero, interest rates on 10-year and 30-year bonds have responded to the hint of inflation by rising 0.58% and 0.86%, respectively from their 2020 lows. This represents an approximate doubling of rates from the bottom.

Important questions for investors will be:

- How much further will rates rise?

- Will the Fed intervene to keep a lid on rates?

- If so, at what level will the Fed act?

I don’t have the answers. Jeffrey Gundlach, who has been named the “New Bond King”, in an interview on CNBC thinks the Fed will let 10-year rates run up closer to 2.50%, maybe 3% before acting. (Note subscription required to view the interview.)

I’m not sure anyone really knows but investors need to add this to the already long list of information inputs. After the big run-up in stock prices, a pop in rates could cause a correction.

Thanks for reading.

The Pendragon Capital Management Team

Click to Download the January 2021 Newsletter

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

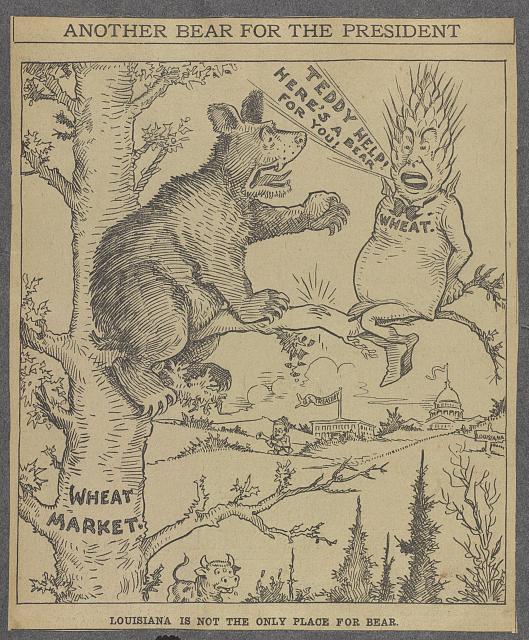

Image credit: Library of Congress, Another bear for president Louisiana is not the only place for bear. , 1907. Photograph. https://www.loc.gov/item/2013651596/.