How does the national debt affect investors, especially when it is so large? Let’s explore.

According to the U.S. Treasury, the national debt is quickly approaching $36 trillion, a fact that has fueled concerns among investors and economists. This means that the federal debt has nearly quadrupled since before the 2008 global financial crisis, and has grown yearly since 2001. This adds to the recurring fiscal debates over budget deficits, the debt ceiling, government shutdowns, stimulus bills, and more.

While the concern is real, the issue’s relative importance among the various items of public importance fluctuates. Politicians and pundits typically tend to bring “The Debt” to the forefront ahead of elections and then it fades somewhat. Politicians out of power like to scream about the debt until they become the government and then they tend to ignore it.

Putting Government Spending into Perspective

With the 2024 election now behind us, attention has shifted to the next administration’s cabinet nominations and policy proposals. How can investors put government spending in perspective and stay focused on what drives markets in the long run?

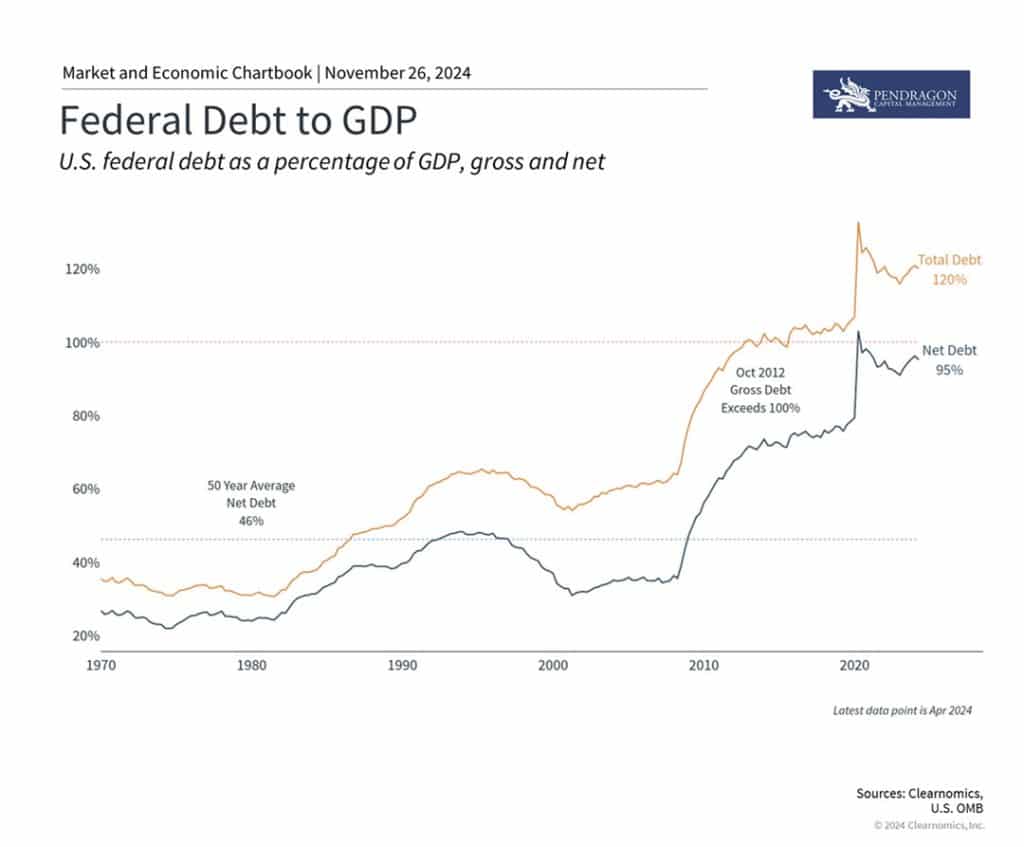

The National Debt Has Grown Rapidly Since 2008

When it comes to challenging issues like the national debt, it’s important to distinguish between what matters as citizens, voters, and taxpayers, and what should matter as investors.

The National Debt and Citizens, Voters & Taxpayers

As individuals, many rightly have strong personal and political views on government spending and taxation, and what it may mean for the country over the coming generations. This will likely hit headlines again when the debt ceiling, which is the maximum amount of debt the federal government is allowed to borrow, becomes a key issue when it’s reinstated in January 2025.

The National Debt and the Economy

These concerns should be distinguished from whether the federal debt directly or indirectly impacts the economy and markets. Without diminishing the importance of the national debt, we need to keep in mind that markets have generated strong returns over the past two economic cycles. Investors should avoid overreacting with their portfolios at the expense of their long-term financial plans.

The size of the national debt relative to the size of the economy provides a clearer picture than the dollar amount of debt alone. There is no getting around the fact that the national debt has grown significantly, but the economy has also doubled since 2008. Specifically, the national debt now represents 120% of GDP. However, this includes debt the government owes to itself, i.e., Treasuries held by government agencies. Excluding these, the government debt is 95% of GDP. This is still sizable and the latest jump is due primarily to pandemic-era stimulus.

What Are the Limits of Government Borrowing?

It’s unclear where the limits of this borrowing are. Japan is the typical example of a developed country with a high debt burden that has exceeded 200% of GDP over the past 15 years, and over 250% since 2020. However, Japan’s situation is not directly comparable since it has a much bigger household saving rate, which helps to offset its significant government debt.

Additionally, the U.S. economy is more diverse, demographic trends are much more favorable, and the dollar plays a far more important role in the global economy.

If there is a problem with the level of debt, investors will likely see it first in the bond market. The ability of the US government to fund itself is expressed in the level of interest rates on US Treasury bonds, especially in the longer-dated part of the yield curve. If confidence in the US to continue to maintain its finances, interest rates will at best be stubborn to go down and at worst, begin to creep up. Investors will demand a higher rate of return commensurate with the level of perceived risk.

Stocks would likely be a second “shoe to drop”.

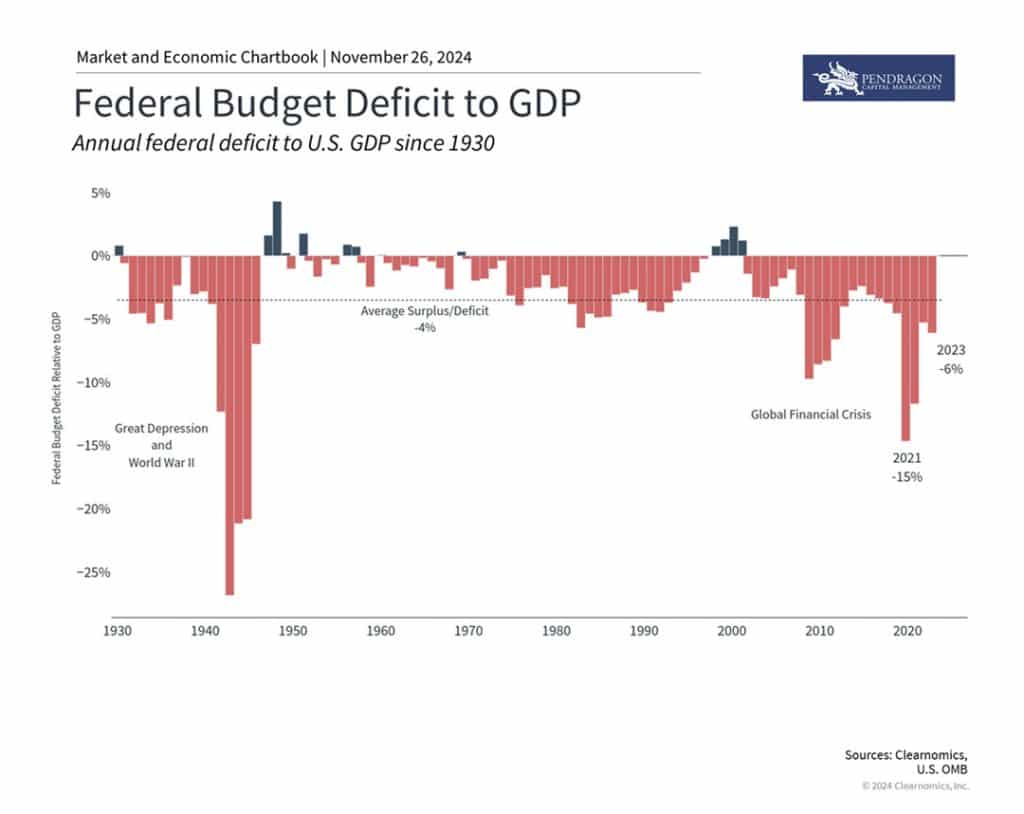

Large Budget Deficits Each Year Have Driven Up the National Debt

How has the federal debt increased so quickly? In two words, budget deficits. Budget deficits occur when the government spends more than it collects in taxes, which adds to the total debt. Taxes here include individual and corporate taxes, as well as social insurance taxes, such as those that fund Social Security, excise taxes, and others. The government also generates revenue from sources such as tariffs; these are small by comparison, making up 2% or less of total government revenue each year.

Even though tax revenues tend to increase as the economy grows (even without raising tax rates), they have been outpaced by government spending over time. These expenditures have grown across what are known as “mandatory” programs such as Social Security and Medicare as well as so-called “discretionary” items such as defense and education.

Government borrowing funds the shortfall, i.e., by issuing Treasury securities. Investors, institutions, and other countries buy these Treasuries and, in effect, fund the federal government.

The current deficit of around 6% of GDP is by no means small, but there have been many periods across history – primarily during economic downturns and wars – when the government has been forced to spend at these levels. History shows that, over time, deficits improve as the economy stabilizes, even if they don’t turn into surpluses.

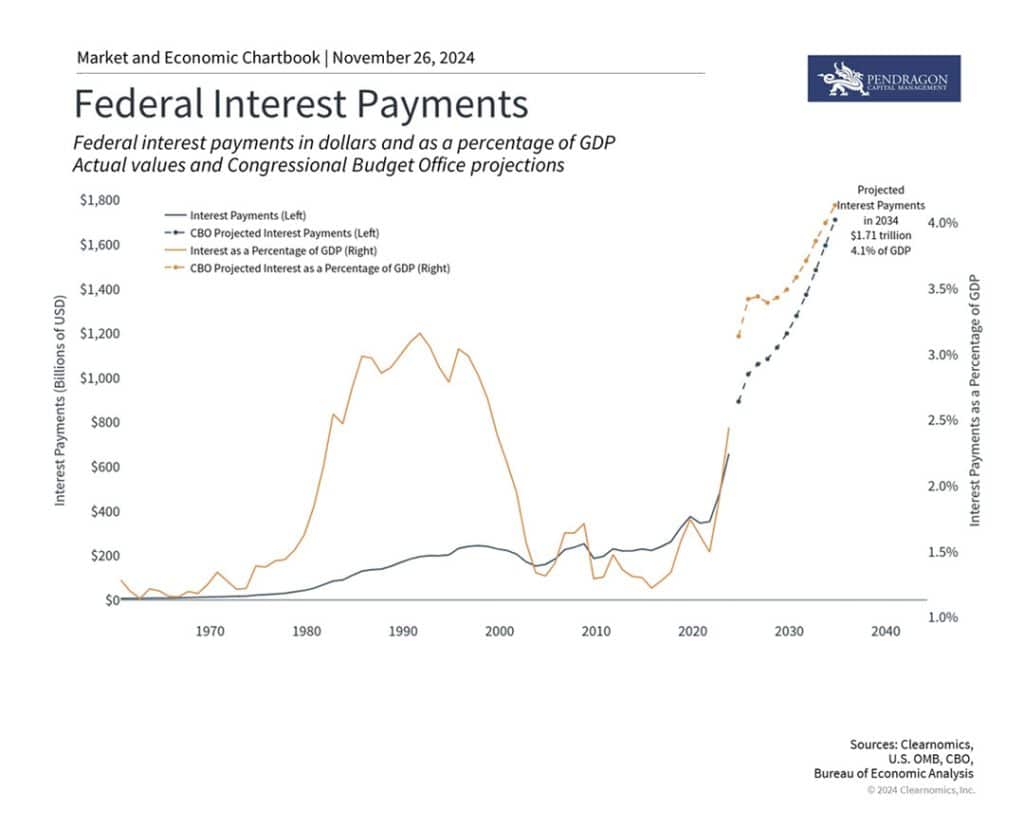

The Debt Burden Will Only Grow as Interest Payments Rise

The unfortunate reality is that deficit spending does not seem to be going away, with neither major party focusing on the issue. The last balanced budgets occurred during the Clinton years and the Nixon administration before that. The accompanying chart shows that left unchecked, government projections suggest that interest payments on the debt alone could rise to $1.71 trillion in ten years.

U.S. citizens or the government itself hold about two-thirds of the national debt. Other countries hold the rest with China owning about 2.2% of the U.S. government debt, although this proportion has declined.

U.S. Debt Still Perceived as a Safe Haven

Many investors worry that growing debt levels mean that Treasuries could be less attractive in the future. In the extreme, this could hamper the government’s ability to roll its debt, possibly leading to skyrocketing interest rates, or weaken the dollar’s standing as the world’s reserve currency. Ultimately, many worry that the U.S. could lose its position in the global economy.

While this is possible, it does not seem likely just yet, even with increased enthusiasm for dollar alternatives such as cryptocurrencies and gold. This has been a concern among economists for many decades. And yet, when the global economy faces distress, investors and governments turn to the U.S. as a safe haven. In 2011, for instance, when Standard & Poor’s downgraded the U.S. debt during the fiscal cliff standoff, investors didn’t sell their Treasuries – they rushed to buy more. Counterintuitively, this is because U.S. debt securities are still the standard for stable, risk-free assets in the world, despite these challenges.

Markets Have Done Well Regardless of the National Debt

Finally, and perhaps most importantly, markets have done well regardless of the exact level of government debt and taxes over the past century. Ironically, the best time to invest over the past two decades has been when the deficit has been the worst. These periods represent times of economic crisis when the government is engaging in emergency spending, which tends to coincide with the worst points of the market. And while this isn’t exactly a robust investment strategy, it underscores the importance of not overreacting to fiscal policy in one’s portfolio.

Technology and Healthcare Advances and the National Debt

While it may be hard to believe, all hope is not lost. It may be possible, through advances in technology and healthcare, to bring down the deficits and slow the national debt’s growth rate. The US government could be looked at as a healthcare and pension plan with an army. For example, if advances in healthcare like GLP-1 drugs offering significant health benefits could lower system-wide costs, that would be a major positive. At-home healthcare for the aged is another possibility to lower costs.

The Bottom Line on the National Debt?

The federal debt is a complex and controversial topic. It is a problem but it’s uncertain with a range of outcomes. As with many heated issues, it’s important for investors to be vigilant while also separating their personal concerns and not necessarily reacting with their hard-earned savings or investments.

Thanks for reading.

Notes

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results.

Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property.

All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Image credit: Eh! l’argent est rare! à qui le dites-vous? bon Dieu!, Paul Gavarni, 1846, Rijks Museum