How familiar are you with the hydrogen energy market?

While more traditional renewable energy sources such as solar and wind are still leading in terms of investment, hydrogen energy, specifically something called “green hydrogen”, is being discussed as a serious source of renewable energy. Hydrogen’s ability to act as a hybrid between an energy generator and transmitter gives it potential for broad utility across industries. This makes for an interesting space for investors to watch.

The Early Stages of Hydrogen as a Renewable Energy Source

Hydrogen as a renewable energy source is complicated and in its early stages.

You’ll find both large industrial players as well as start-ups trying to figure out if hydrogen is viable. Investors need to be cautious. This article provides a basic outline of hydrogen as an energy source. It includes no recommendations. We name companies only as examples.

Government entities have passed legislation to incentivize renewable energy investment and usage, such as the Inflation Reduction Act in the U.S., which is expected to spur over $4 trillion of investment in renewable energy over the next decade according to a study by EY[1].

New investment in renewable energy reached $495 billion worldwide in 2022, up 36% from just two years prior according to Statista[2].

What is the Hydrogen Energy Process?

To understand the potential usage of hydrogen, investors should understand the basics of how hydrogen energy works.

Unlike primary sources of energy such as nuclear energy, coal, or wind power, hydrogen, according to the Energy Information Administration[3], is what scientists refer to as a secondary source of energy because it must be chemically converted to a usable form to generate electrical power.

Hydrogen is primarily an energy carrier. So how does it become electricity?

Split Hydrogen from Water Molecules

To eventually generate power from hydrogen, the element must first be obtained on its own. Since most hydrogen exists on earth in water molecules, the molecules must be split using another energy source either through something called steam reforming or through electrolysis[4].

Combine Hydrogen with Oxygen

Then, to generate electricity, you can burn the hydrogen by combining it with oxygen in the air or mix it with oxygen in an enclosed area (usually a fuel cell) and use a catalyst like platinum to spark the combination of the hydrogen and oxygen atoms.

In either process, the combination of the atoms generates heat and electricity, emitting only a water molecule.

Use Renewable Energy for Green Hydrogen

The “green” aspect comes into play at the beginning of this process.

If the energy used to power the hydrogen separation process (steam reforming or electrolysis) comes from a renewable energy source such as wind, hydro, or solar, then this is “green hydrogen”[5]. The actual part where energy is generated is at the end when hydrogen recombines with oxygen. Before that, it was essentially just storing energy.

Companies Involved in Hydrogen Energy: Making & Using

Companies Making Hydrogen Energy

Which companies are manufacturing the technology for hydrogen power? One of the most well-known is Siemens Energy which produces electrolysis systems for separating hydrogen from water.

Toshiba Energy is also producing these systems.

Ballard Power Systems produces fuel cell stacks for automobiles (fuel cells are basically batteries where hydrogen recombines with oxygen to produce electricity).

Companies in the industrial gas space such as Air Products and Air Liquide also extract, store, and distribute hydrogen.

Companies Using Hydrogen Energy

Two of the most important areas where hydrogen energy will be used are transportation (either automobile, train, or plane) and storage.

Transportation

With regards to automobiles and transportation, Honda, Hyundai, and Toyota are the major players as these are the only companies to offer a hydrogen-powered vehicle on the market.

In the aviation subsegment, Airbus has been one of the only companies to announce plans for a hydrogen-powered plane. A CNN article from December 2022 notes that the company plans on redesigning its A380 superjumbo model to run entirely on hydrogen, a project that is expected to yield test flights by 2026[6].

Energy Storage

In the use of hydrogen as a store of energy, Mitsubishi Power and Magnum Development are two companies currently developing a plant in Utah that will store over 1000 megawatts of renewable energy in salt caverns, mainly in the form of hydrogen[7].

Storing energy in the form of hydrogen, these companies believe, will prove to be more cost-effective over the long term than storing energy in batteries.

Pros & Cons: Is Hydrogen Energy Viable?

Next, let’s weigh the costs and benefits of hydrogen as a renewable source of energy.

In Favor of Hydrogen Energy Viability

1 – Hydrogen is Plentiful

Hydrogen is one of the most abundant elements in the universe, making up about 70% of the universe according to an article by Forbes[8], and although pure hydrogen is relatively rare on Earth, it can be found in water (H20) which itself makes up 70% of the Earth.

2 – Hygrogen Supports Renewable Energy

Because hydrogen alone is not an energy source, it needs primary sources of energy to become useful.

Naturally, renewable energy sources are a great option for implementing hydrogen usage, especially considering they can be used to store excess energy from wind and solar which often gets wasted[9]. This can be stored and then used during times when there is little wind or sunlight.

Hydrogen helps solve the limitations of the two most popular renewable energy sources, thus promoting the renewable movement. Utility company Iberdrola[10] in an article on the subject, points out that when used in fuel cells, hydrogen only emits water vapor.

3 – Hydrogen Has Vast Commercial Uses

Hydrogen can be used in many industries, mainly transportation via hydrogen vehicles, but also in airplanes. Because hydrogen is light and not very dense, it can be compressed into a relatively small fuel cell, of which multiple can be used to power a plane instead of a heavy battery, making aviation cleaner.

According to an article by AZO CleanTech[11], it can also be used in steel production as an alternate injection material for traditional blast furnaces.

Hydrogen has even been used by NASA to generate energy in space capsules.

Against the Viability of Hydrogen Energy

1 – Hydrogen is Expensive

Hydrogen production and storage are extremely expensive. Hydrogen energy can cost between $8 to $10 more per kilogram than gas, and according to the International Renewable Energy Agency, green hydrogen costs are the equivalent of paying $250 to $400 per barrel of oil[12].

The lack of current infrastructure for hydrogen energy production is not helping either. Currently, there are only 33 active green hydrogen facilities in North America according to an article by STEM workforce provider AirSwift[13]. The 30 hydrogen projects currently underway are expected to cost a combined $14 billion. That is about $470 million per project according to the same AirSwift article.

Overcoming these barriers and bringing hydrogen energy to a larger scale to reduce costs will be a long process.

Fuel cells are also extremely expensive, on average costing roughly $50,000 according to a CNBC interview with Haim Israel, Managing Director at Bank of America securities.[14]

2 – Hydrogen Energy Needs to be More Efficient and Consistently Green

Hydrogen isn’t that efficient or environmentally conscious.

The Economist notes that, currently, most hydrogen production processes use electricity from fossil fuels to power the electrolysis process, emitting a good amount of carbon dioxide, exactly what hydrogen promises to not do[15]. In fact, hydrogen was responsible for 830 million tons of carbon dioxide in 2022, the same amount as the U.K. and Indonesia combined according to the International Energy Agency[16].

When renewable energy is used to obtain and generate power from hydrogen, the energy output from the process is sometimes less than the input, making this a very inefficient process. A study by Volkswagen showed that 70% of the hydrogen fuel cell’s efficiency is lost by the time there is usable energy[17].

3 – Tricky Hydrogen Storage, Transportation, and Safety Concerns

Because hydrogen is very low in energy density, it requires either large storage containers or highly pressurized containers, which are costly to produce and maintain[18].

Also, hydrogen is highly flammable, adding to the necessary precautions when storing and transporting it, further adding to the costs.

For Investors – Hydrogen Energy Opportunities

While it seems like hydrogen energy is a long way away from operating on a large scale, there will undoubtedly be investment opportunities most likely in tangential industries.

Utility and Energy Company Investments

Investing in the utilities and energy companies that provide hydrogen energy is one way to approach the technology. However, they are likely to be the ones bearing the initial costs associated with producing hydrogen.

However, there does seem to be room to grow. According to a study done by Power Engineering International (PEI), 45% of energy companies worldwide have hydrogen accounting for less than 1% of their top line, but 44% expect hydrogen to account for more than 10% by 2025 and almost 70% by 2030[19]. At the same time, CNBC notes that the hydrogen market is expected to increase to $2.5 trillion by 2050, with hydrogen as a share of global energy usage increasing from 4% today to 22% by the same year, signaling massive growth[20]. Still, the PEI study notes that the energy company executives surveyed expect major cost headwinds will eat into margins in this space.

Government incentives could help, like the EU’s plan to allocate $500 billion to hydrogen power users and producers by 2050 according to a CNBC article that breaks down the EU’s $1 trillion climate plan, as well as the Biden Administration’s $7 billion hydrogen-specific plan announced in late 2022, but these plans have not been fully rolled out[21].

As hydrogen, and particularly green hydrogen, becomes more popular, investing in companies that aim to capitalize on the lower long-term costs of storage may turn out to be promising.

Hydrogen Energy Opportunities in Transportation

As mentioned previously, transportation is a promising use case.

Currently, there are a little over 50,000 hydrogen-powered cars on the road today based on figures from GM Authority[22]. Compare this with electric vehicles, of which there are over 20 million with plenty of room to grow, and it’s clear that there is plenty of growth potential for hydrogen cars. Asian car manufacturers Toyota, Honda, and Hyundai are the only companies with commercially available hydrogen models. They are expected to increase production over the coming years. Honda expects to sell 60,000 hydrogen units by 2030 according to Forbes.[23]

In addition to consumer automobiles, Toyota and Hyundai are investing heavily in hydrogen-powered trucks, and Nikola plans to start production of hydrogen trucks this year[24]. David Antonelli, the CEO of Kubagen, a hydrogen power manufacturer, in an interview with CNBC, points out “The larger the vehicle the more reasonable hydrogen fuel cells are… using a battery would be ridiculous”[25]. So, hydrogen truck manufacturers are another place to look to invest.

Hydrogen Fueling Stations

Hydrogen vehicles also raise the question of power stations, which are still a problem for EVs let alone hydrogen cars. Currently, there are only 66 fueling stations in the U.S., a huge market gap, leaving room for companies like FirstElement Fuel which already owns a majority of the fueling stations in the U.S., concentrated in California[26]. As tax incentives start attracting hydrogen vehicles, hydrogen fueling stations will certainly benefit.

Air Travel Opportunities

In the air, companies like Airbus look to be another area for hydrogen power growth. After all, hydrogen is a much better option for air travel to go green than with heavy batteries.

But, because Airbus doesn’t plan to start testing for a couple of years, investors will have to wait to realize the benefits of hydrogen in the airline segment. Rolls Royce is testing hydrogen engines. If they sell to companies like Airbus who need hydrogen engines, theoretically aircraft engine manufacturers like Rolls-Royce and General Electric will be able to make money in this space, opening yet another door for investors.

Final Thoughts on the Hydrogen Energy Market

Overall, investors will find multiple avenues to get involved in hydrogen power. These range from hydrogen energy producers, to fuel cell manufacturers, to automotive and aviation companies.

There is plenty of room for growth and potentially high returns, but because this is a new space, investors should proceed with extra caution when investing in hydrogen power in any capacity. Such speculative enterprises and new technologies are not suitable for many investors. As with all investments, seek advice from your financial advisor and tax professional before investing.

Thank you for reading. If you enjoyed the content, please share it with your contacts. Don’t hesitate to reach out with any questions. If you are interested in investing in the global energy transition, please see our website. You can also send an email to ian@pendragon-capital.com, or call us at 917-837-2287

>> Schedule a Complimentary Investor Consultation <<

Special thanks to Timothy Patterson for his research on this topic. He is a rising sophomore at Bentley College and Pendragon Capital Management Summer Intern.

Thanks for reading.

Image Sources:

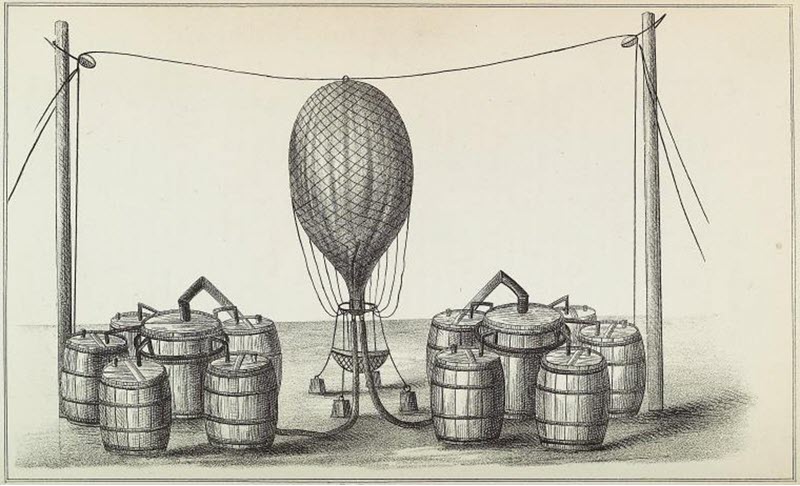

English War Work: The Balloon-Shed, 1916, Joseph Pennell (American, 1857–1926) America, 20th century, Lithograph, the Cleveland Museum of Art

Rare Book Division, The New York Public Library. (1850). Inflation of balloon Retrieved from https://digitalcollections.nypl.org/items/c3eebe1b-b0fc-2c3c-e040-e00a1806223a

Edouard Manet, French (Paris 1832 – 1883 Paris), The Balloon, Print, 1862

[1] https://www.ey.com/en_us/power-utilities/4-forces-shaping-us-utilities-in-2023?WT.mc_id=10851380&AA.tsrc=paidsearch&s_kwcid=AL!10073!3!662320237893!p!!g!!hydrogen%20company&gad=1&gclid=CjwKCAjw5MOlBhBTEiwAAJ8e1nUJxfv9k3vngsqnlc8k_2SRQH8yU7qx1yuTGvE7YAjlD1fLdmHRHxoChokQAvD_BwE

[2] https://www.statista.com/statistics/186807/worldwide-investment-in-sustainable-energy-since-2004/

[3] https://www.eia.gov/energyexplained/hydrogen/

[4] The Economist video https://www.youtube.com/watch?v=fkX-H24Chfw

[5] https://www.acciona.com/green-hydrogen/?_adin=02021864894

[6] https://www.cnn.com/travel/article/airbus-fuel-cell-engine-rolls-royce-easyjet-engine-c2e-spc-intl/index.html

[7] https://www.pv-magazine.com/2022/08/04/worlds-largest-underground-hydrogen-storage-project/

[8] https://www.forbes.com/sites/startswithabang/2020/05/25/this-is-where-the-10-most-common-elements-in-the-universe-come-from/?sh=4d0bc01ad24b

[9] https://www.siemens-energy.com/global/en/priorities/future-technologies/hydrogen.html

[10] https://www.iberdrola.com/sustainability/green-hydrogen

[11] https://www.azocleantech.com/article.aspx?ArticleID=1606

[12] https://theconversation.com/green-hydrogen-sounds-like-a-win-for-developing-countries-but-cost-and-transport-are-problems-191295#:~:text=Today%2C%20green%20hydrogen%20has%20an,the%20International%20Renewable%20Energy%20Agency

[13] https://www.airswift.com/blog/green-hydrogen-projects-usa#:~:text=There%20were%2033%20operational%20Green,tons%20per%20annum%20(MTPA)

[14] https://www.youtube.com/watch?v=aYBGSfzaa4c&t=65s

[15] https://www.youtube.com/watch?v=fkX-H24Chfw

[16] https://www.iea.org/reports/the-future-of-hydrogen

[17] https://www.volkswagen-newsroom.com/en/stories/battery-or-fuel-cell-that-is-the-question-5868

[18] https://energytracker.asia/pros-and-cons-of-hydrogen-energy/#:~:text=Hydrogen%20energy%20has%20many%20pros,in%20the%20global%20energy%20transition

[19] https://www.powerengineeringint.com/hydrogen/lack-of-infrastructure-the-biggest-threat-to-hydrogen-economy-survey/

[20] https://www.youtube.com/watch?v=aYBGSfzaa4c&t=65s

[21] https://www.cnbc.com/2020/01/15/eu-wants-to-spend-1-trillion-to-help-make-it-climate-neutral-by-2050.html

[22] https://gmauthority.com/blog/2023/02/56000-hydrogen-powered-vehicles-on-the-road-so-far/#:~:text=GM%20has%20no%20production%20hydrogen,this%20alternative%20fuel%20propulsion%20system.

[23] https://www.forbes.com/sites/kensilverstein/2023/06/19/automakers-are-gearing-up-to-get-ahead-of-ev-and-hydrogen-trends/?sh=2e02c5b61456

[24] https://finance.yahoo.com/news/nikola-stock-surging-on-hydrogen-fuel-cell-truck-and-supply-deals-183804368.html

[25] https://www.youtube.com/watch?v=aYBGSfzaa4c&t=65s

[26] https://www.nytimes.com/2020/11/11/business/hydrogen-fuel-california.html

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.