Inflation is in the news, as are rising interest rates. Can stock prices hold up against this backdrop of rising interest rates? Read on to learn more.

>> To subscribe to this monthly newsletter, click on Subscribe!

Inflation Report Sends Interest Rates Up

This week the markets got another hot inflation report. This sent interest rates shooting higher. The 10-year US Treasury yield broke above 2% for the first time since the summer of 2019.

The persistent inflation raised the probability that the Federal Reserve will need to raise the Fed Funds rate by at least 25 bps at the March 16th meeting. The expectation is that the Fed will need to continue to raise rates throughout 2022 to combat higher prices.

Raising rates is a tricky business.

- Raise them too little and inflation can stay stubbornly high.

- Raise them too much and the Fed could throw the economy into recession.

>> See Concerned About Inflation?

The Market is a Discounting Mechanism

The market is a discounting mechanism. Prices move in anticipation of a range of possible future outcomes.

The S&P500 index, in response to inflation, rising rates, and the possibility of a recession, has fallen about 8% from its January high.

The Nasdaq is down 14% from its November 2021 high.

Investors clearly are making adjustments. High-flying stocks trading at ultra-high multiples of earnings have been taken down far more dramatically. Some are down 50%, 60%, or more.

Those stocks probably should never have traded at those heights but with rates near zero and speculation abounding, prices were bid way up for companies with exciting plans but with no profits for years.

>> See Investing in Times of 20+ P/Es

Focus on Fundamentals and Some Sense of Stock Value

In today’s environment, the appetite for such stocks is not there and prices have tumbled.

On balance, it is probably a good thing that speculative excess is being wrung out of the market. Investors again are turning their attention to fundamentals and some sense of value.

Geopolitics and Fear of a Russion Invasion of Ukraine

This week, geopolitics threw a wrinkle in the story. Fears of a Russian invasion of Ukraine sent investors selling risk assets and buying safe havens like US Treasuries. In fact, when reports circulated of a possible invasion over the weekend the 10-year rate reversed course and dropped back below 2%, to 1.91%.

It’s hard to handicap whether Russia will move on Ukraine. If an invasion happens, in the short run, stocks will be under pressure. Treasuries will likely rally. Oil, natural gas, and other commodities will rally. Russia is a key producer of aluminum, nickel, oil, and natural gas.

Ultimately, the impact will be muted. Not to ignore any loss of life but Ukraine is a small country. Its GDP is about $165 billion. As a comparison, Apple’s annual net income is about $100 billion.

>> See Market Volatility, Expectations & the Global Markets

Stock Prices Against a Backdrop of Rising Interest Rates

An important question facing the market is whether stock prices can hold up against a backdrop of rising interest rates.

If the economy is returning to normal, so should rates. The 2-year Treasury is almost back to where it was prior to the COVID slump of March 2020. Corporate earnings reports for the 4th quarter of 2021 are by and large coming in strong. According to FactSet, with 72% of S&P500 companies reporting, 77% beat expectations.

With the market in a correction and earnings rising, the market’s forward price-to-earnings ratio has moved from about 22 times to 19.7 times. With rates likely to move higher, the multiple is probably going to continue to move down. If corporate earnings per share can keep rising, it can offset.

Having said that, the stocks that are trading at the highest multiples are likely to have the greatest multiple compression. These stocks tend not to have profits so there isn’t much to counter P/E compression.

Focus on Stocks Selling at Reasonable Prices

It is always prudent to buy stocks that sell at reasonable prices. This is especially true in periods where there is less appetite for risk. Investors should look for lower P/E stocks that have some growth.

With inflation still a factor, shares of companies that have pricing power are attractive as are firms that are involved in commodities like metals and agriculture.

Investing in countries where the economy is commodity-based, could also be profitable.

However, while these commodity plays are fine for today, it is not a given that inflation will continue at the same pace.

Beware Recency Bias in Markets

Recency bias is a strong force in markets and it is risky to assume that trends continue forever. The markets position towards recent trends and if there is a sudden change, a violent swing in the opposite direction can happen.

Speculative money was pouring into high valuation e-commerce and so-called “disruptors”; when conditions changed, money left just as fast. Looking for lower valuations might lead investors to non-US markets. Valuations are lower in Europe and Japan and in some emerging markets.

The US has outperformed other developed markets by large margins. Under conditions where multiples are challenged, this could change.

Thank you for reading.

>> Download the February Newsletter <<

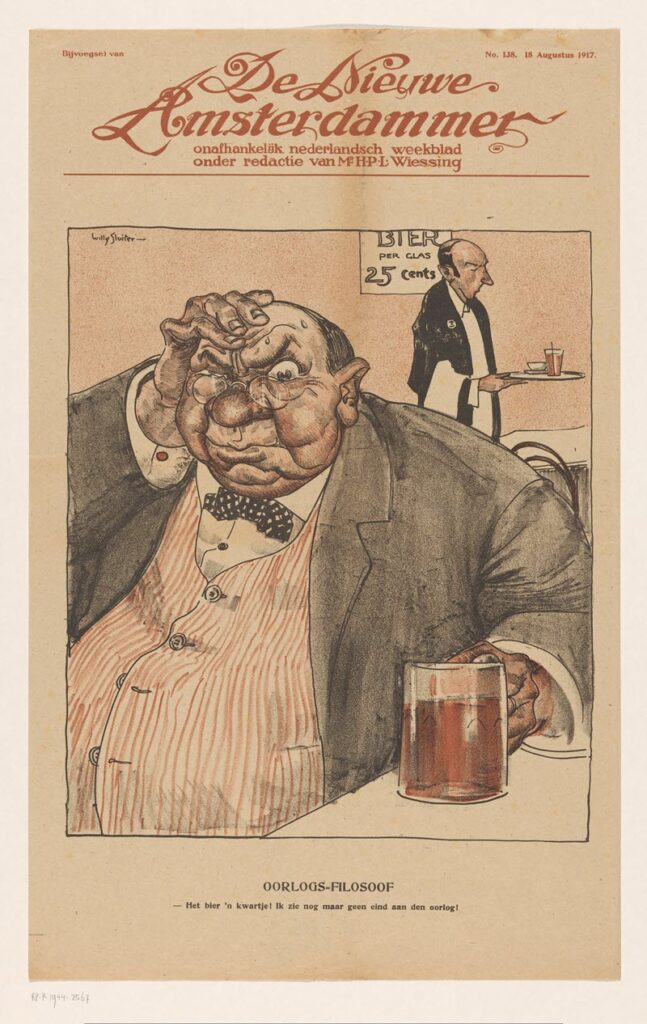

Image credit: War philosopher, Willy Sluiter, in or before 1917; lithograph in black and red and text in letterpress, h 498mm × w 311mm; Rijks Museum

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.