The bear market is still alive and well, and full of surprises.

I read a Tweet posted by long-time technical analyst Walter Deemer that said,

“In a bear market, the surprises tend to be negative.”

>> To subscribe to this monthly newsletter, click on Subscribe!

Stronger Consumer Price Index & Wild Dow Jones Swings

This was the case this past week when, contra to analysts saying inflation is moderating, the CPI came in stronger than expected. With inflation stubbornly high, mostly due to housing and shelter costs which make up over 30% of the CPI, all those anticipating a Fed pause or even lowering its expectations of how high rates need to go were disappointed.

After the CPI report was released, the Dow Jones Industrial Average proceeded to fall over 500 points. In a stunning turn of events the Dow Jones did an about-face and ended the day up over 800 points – a 1,300-point intra-day swing. Instead of this wild day sparking a rally, the market fell over the next two days. The bear is still alive and well.

How to Change from a Bear Market to a Bull?

What will change a bear to a bull?

Inflation Must Come Down

Inflation has to come down. The next CPI report comes out on November 10th. The Fed seems resolute in its campaign to fight inflation.

Fed Intervention

There is talk (and some truth) that if by raising rates so quickly, the global financial markets may become unstable, requiring the Fed to intervene. There is some precedent for this and, in the UK and Japan, bond markets are having difficulty. I would not assign a high probability to this but Fed intervention to ease global market conditions would be a lift for stocks.

Russia/Ukraine Conflict Resolution

If there is some resolution to the Russia/Ukraine conflict, markets would rise. This too seems a low-probability event in the short run.

Corporate Profits

Earnings season is here and if corporate profits hold up, that would be helpful to stocks. The math holds that P/E multiplied by earnings equals stock price. Rising rates have lowered the market’s P/E from over 20 to now about 16. Earnings estimates have gone down but not by that much.

The Market Moves in Advance of Events

If earnings hold up, investors could feel relieved and buy stocks. The stock market usually moves in advance of events. We are likely to see the market bottom before the economy does and before interest rates top out. Investors need to be nimble and open-minded and not let recent price actions prevent them from re-positioning their portfolios from defense to offense.

For now, though, we are in a bear market and investors need to exercise caution. Until proven otherwise, surprises still favor the bears.

Where to Hide in Bear Markets?

Other than cash, there is nowhere to hide in a Bear Market.

Market strategists might tell you that real estate, gold, and commodities are the place to be when there is inflation. We have been experiencing the biggest increase in inflation since the 1970s and yet the Vanguard Real Estate ETF (VNQ), is down 33% this year.

The SPDR Gold ETF (GLD) has declined 8.4% in 2022 (down 20% since March 2022) and while commodities were very strong first due to COVID supply dislocations and then due to the Russia/Ukraine War, the Invesco Commodity ETF (DBC) peaked in early June and has declined almost 18% since.

Markets: Not Simple, One-Dimensional Systems

For reference, the S&P500 is down about 24% year-to-date. It is important to understand that markets are not simple, one-dimensional systems.

As an example, two forces came into play in this bear market cycle that have not been supportive of commodity prices.

Commodities Don’t Produce Cash Flow

First, commodities do not produce cash flow. As such, rising interest rates increase the opportunity cost of putting the money you would invest in commodities into some assets like US Treasuries that throw off interest income.

Higher opportunity cost lowers the price of an asset like commodities.

Strong US Dollar

The second feature we are experiencing is a strong US dollar. Most commodities are priced in US dollars and therefore become more expensive to most of the world. This hurts global demand, putting downward pressure on commodity prices.

Real Estate Investments

Most individual investors, aside from their homes, invest in real estate through real estate investment trusts or REITs. Rising inflation helps real estate if landlords are able to increase rents or if hotels can increase room rates. However, the rapid interest rate increases hurt the value of all assets, including real estate.

Additionally, real estate is financed by debt and if rates rise, the cost of debt increases, squeezing profits.

Plus recession fears call into question whether real estate owners can raise revenues if overall economic demand is lower. Even within real estate, different parts of the market can behave differently. For example, the future of office buildings is clouded by the post-COVID work-from-anywhere phenomenon. Hotels may benefit from post-COVID “revenge travel”.

Remember that Bear Markets Favor Negative Surprises

And that means that there’s a lot to analyze, and investors need to exercise caution.

Thanks for reading!

>> Download the October 2022 Newsletter <<

This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.

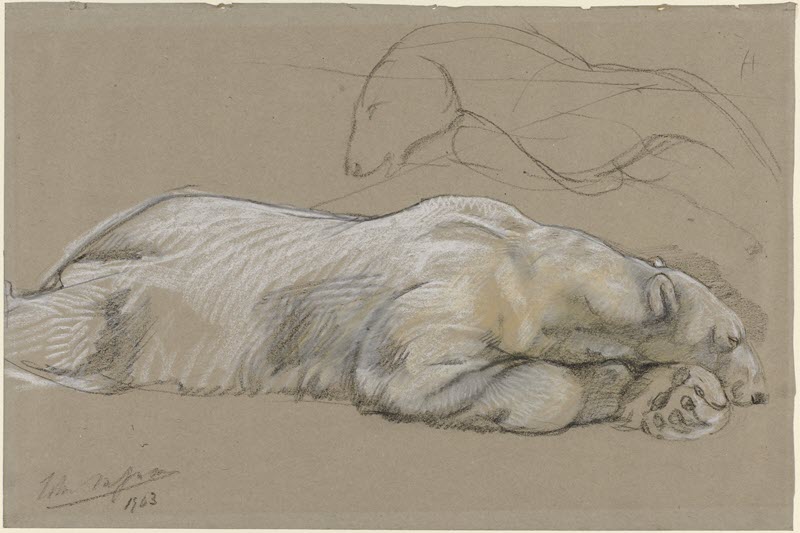

Image Credit: Studies of a Recumbent Polar Bear, John Macallan Swan, 1903, Rijks Museum