The transition to renewables from fossil fuel generation is happening around the world. As an investor, you’ll want to consider the opportunities while remaining aware of the risks.

Renewables Replace 20% of European Fossil Fuel Energy Generation

According to a June 3, 2024 Reuters article titled EU wind and solar growth displaces fossil fuel generation, report says, wind and solar power generation in the European Union increased 46% from 2019 to 2023. Looking at this from a different angle, according to think-tank Ember, 20% of European Union fossil fuel power generation has been replaced by renewables.

- EU wind power generating capacity now stands at 219 GW.

- Solar capacity is 257 GW.

A single GW is enough to power 750,000 homes per year.

On average, over the past four years, every day saw 230,000 solar panels installed in the EU. With the growth in solar and wind power generation, renewables are now 44% of the EU’s electricity mix. This is up from 34% in 2019. Of course, everything is complex. It is not always a windy day and we experience night-time. The wind and solar capacity quoted does not actually produce electricity at capacity all the time.

However, there have been days when renewables have provided the entire electricity needs of some countries. For example, in November 2023, Portugal experienced strong winds for six straight days. Wind power plus other renewable sources like hydropower were enough to meet the country’s energy needs.

Renewable Energy Storage

To better the chance of replicating and expanding the Portugal experience, there needs to be more and better storage.

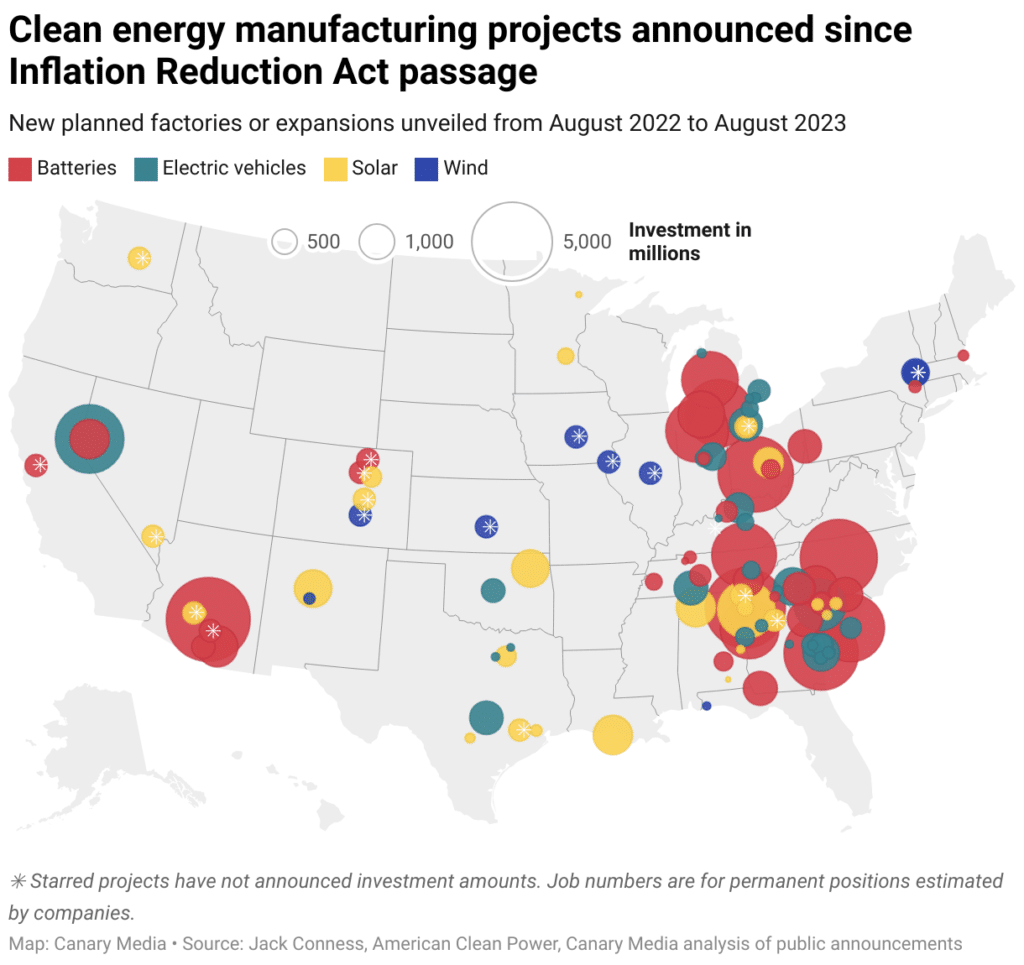

In the U.S., the largest share of funds appropriated for the Inflation Reduction Act has been allocated to battery production.

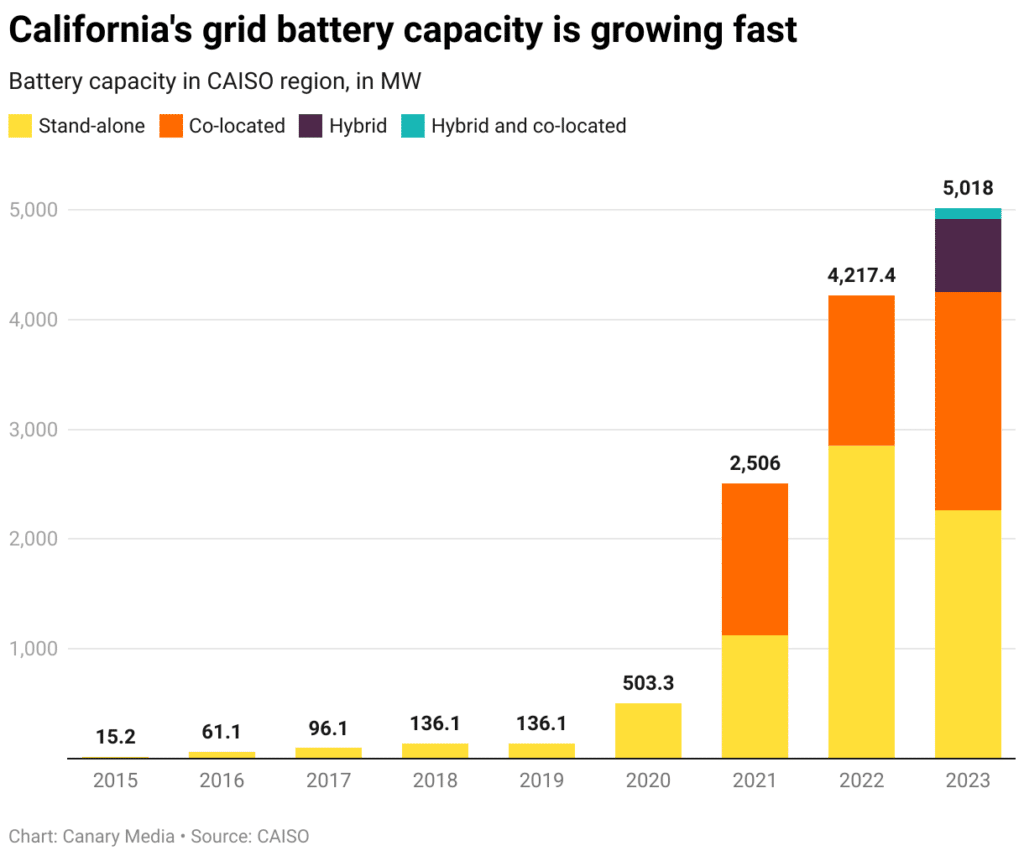

According to California’s grid operator California ISO, California’s energy storage capacity has increased by a factor of 10 over the past three years. By the end of 2023, California had 5GW of storage in the CAISO utility systems.

This does not include other smaller systems in the state.

Decreasing Renewable Energy Costs

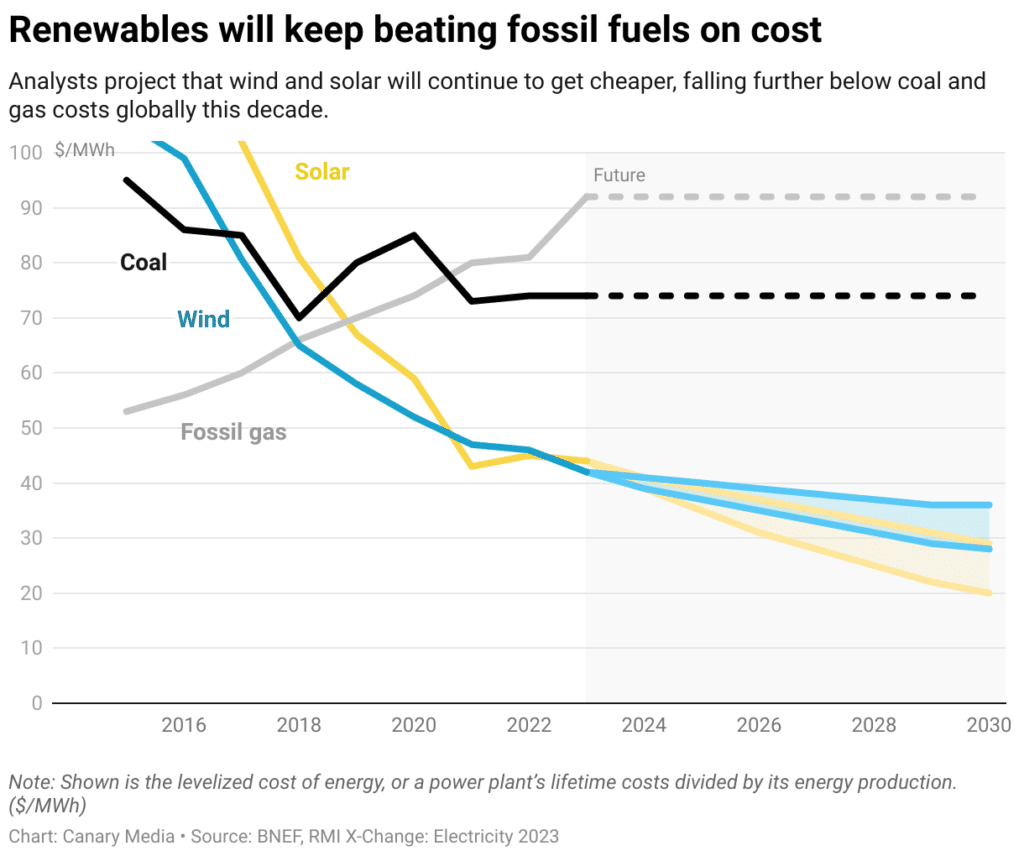

As wind, solar, and battery production increases, the costs come down. The cost to build new wind and solar power generation has fallen to levels below that of Newfield coal plants.

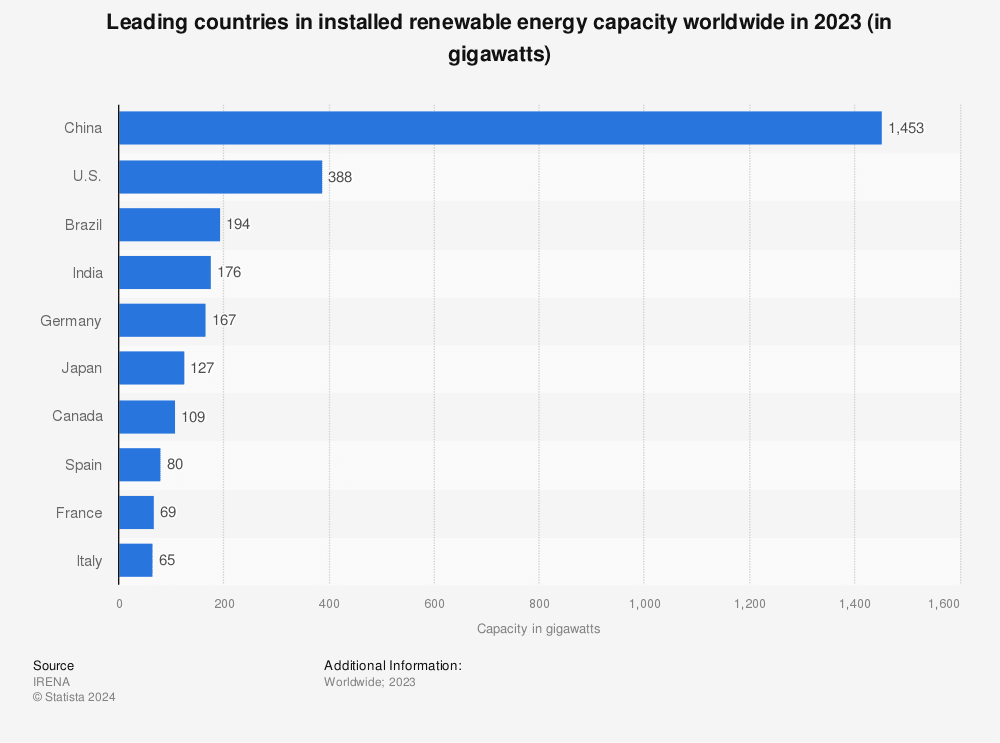

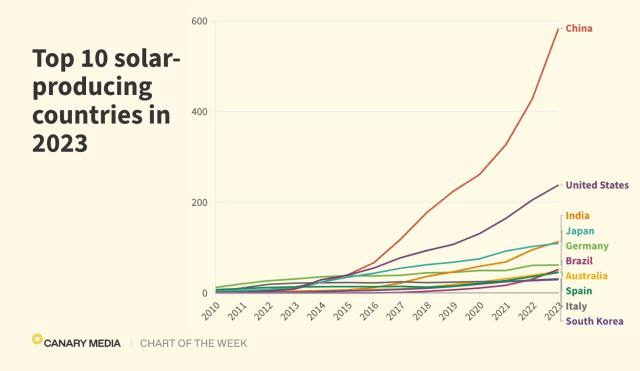

The innovations in renewables and power generation are truly a global phenomenon. China has the largest installed renewable capacity by far.

While China leads in installed solar capacity, it also leads in continued growth in solar power generation. However, it is not entirely a China story. Growth in renewables like solar is happening in many countries.

Demand for Renewable Power Fueled by AI and Data Centers

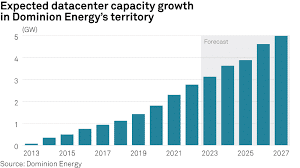

Boosting interest in power generation, from the demand side, is the rapid deployment of data centers and Artificial Intelligence. As more applications move to The Cloud and AI requires more computational power, we can expect the demand for electrons to grow significantly.

The chart below, from US utility company Dominion, illustrates a rapid increase in the number of data centers in its territory.

These data centers will need even more energy to power themselves. The above image is for only Dominion Energy, multiply this by all the utilities across the country and even the globe and you can easily understand that electricity demand will be significant, and will require more renewable energy capacity to meet the demand.

Renewable Energy = Opportunity for Investors

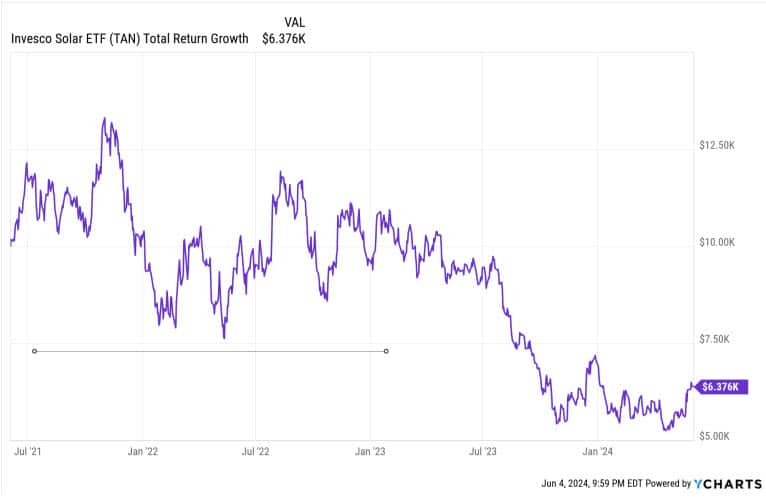

With dynamic change occurring in power generation, storage, and transmission, investors will have new opportunities. New development means significant risks. Competition is fierce, manufacturing is complex, each country has unique regulatory challenges, technology continually evolves and the supply and demand for equipment and components can swing dramatically. Investors should tread carefully but keep an eye on renewable energy.

Renewable Energy Stock Pressures

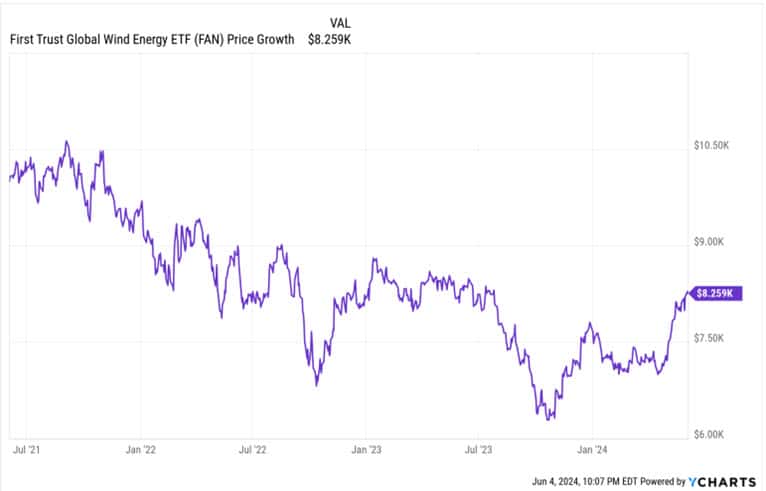

The challenges facing investors can be seen in the following investment performance graphs. Despite the growth of wind and solar installations, the stock prices of companies in they field have been under pressure.

This chart shows that $10,000 invested three years ago in shares of TAN, the popular solar Exchange Traded Fund (ETF), would be worth just $6,376 today.

Similarly, a $10,000 investment in FAN, the ETF that represents companies in wind power generation would be worth only $8,259 today.

The Role of Interest Rates & Supply Chain Logistics on Renewables

What could turn share prices up, better reflecting the growth of renewable power generation?

One factor would be interest rates. If the global Central Banks lowered rates, the cost of borrowing money to build renewable power projects would go down therefore more projects could come online.

The New York Times recently published a story titled “As Solar Power Surges, U.S. Wind Is in Trouble,” describing how wind power installation in the US has lagged behind solar. This, the article described, has been a function of wind having a more complicated and more COVID-disrupted supply chain and less of a desire on the part of the public to want large wind towers blowing and marring their scenic community views.

Interested in Renewables Like Solar and Wind Energy?

Don’t hesitate to reach out with any questions. If you are interested in investing in the global energy transition, please see our website. You can also send an email to ian@pendragon-capital.com, or call us at 917-837-2287.

Thank you for reading. If you enjoyed the content, please share it with your contacts.

>> Schedule a Complimentary Investor Consultation <<

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.

Image credit: Hemelkaart van het stelsel van Copernicus, Systema solare et planetarium ex hypothesi Copernicana secundum (…), 1702 – 1742, Rijks Museum