Inflation talk has been featured in the business news as well as in this newsletter for a few months now, and most recently in Market Volatility, Expectations & the Global Markets. Despite all the inflation talk, you’ll notice as you read this article that the stock market reacts inconsistently.

>> To subscribe to this monthly newsletter, click on Subscribe!

Consumer Price Index: Higher Than Expected

This month, the Consumer Price Index, both total and core, came in higher than expected. Inflation was the highest since 2008 when the global economy began to bottom in the last crisis. The CPI rose 0.6% in May following a 0.8% rise in April.

If one annualizes the May number, inflation was up 7.2%. With such a number, one might have thought that interest rates would have gone up – investors demanding higher rates to keep up with higher prices.

10-Year Treasury Note Yield Down

However, the yield on the 10-year Treasury note went down. After the inflation report, the 10-year rate fell to 1.43%, the lowest level since early March. For context, the recent high was 1.745%.

There are a couple of explanations for the break from conventional wisdom.

Temporary Price Increases?

First, the markets may believe that the increase in prices is temporary. As companies re-hire the supply of goods will increase. Similarly, as more supply comes on line, any panic buying will subside. It has been said that the cure for higher prices is higher prices. As items get more expensive, the quantity demanded will fall, easing inflation.

Federal Reserve Buying Bonds

The second possibility is that the Federal Reserve is actively buying bonds to keep rates low. Looking at the Fed balance sheet, there is consistent buying, about $22 billion in the week ended June 9 and another $54 billion for this past week.

Inconsistent Stock Market Reaction

The stock market, like bonds, had a benign reaction to the inflation news. However, this week the Fed met. Chair Powell, said,

“You can think of this meeting as the talking-about-talking about tapering meeting.”

Stocks did not like that. Overall the stock market fell but if you look closely, not much was consistent.

- Bonds rallied pushing Treasury interest rates lower.

- Mortgage rates however went up.

- Industrial, financial, and energy stocks were weak.

- FAANGs and growth stocks did relatively well.

Seems like the safety trade these days is to buy Treasuries and FAANGs.

Cool-Off for Sectors with Recent Run-ups

For all the talk of inflation, commodity-related stocks like miners dropped.

While the Fed indicated that maybe two rate hikes might happen in late 2022 or into 2023, investors nevertheless used it as an excuse to sell sectors that have had substantial recent run-ups. Financials, miners, and materials stocks have been very strong as re-opening trades. The Fed cooled them off.

The Fed is also trying to use its megaphone to move mortgage rates up a bit to try to alleviate some froth in the housing market. All in all, it looks like we may be in store for a choppy month or so as investors re-balance over-extended stocks.

Inflation: Good or Bad?

- Inflation is generally perceived as bad for bonds as inflation typically pushes interest rates higher and therefore bond values decline.

- With stocks, the relationship between inflation and returns is less straightforward. Inflation can help certain companies and hurt others.

- In cases where inflation increases revenues faster than costs, inflation is a plus.

- For companies that have significant debt, higher revenues from inflation allow for more dollars to pay fixed debts.

- Other things being equal, real estate, some industrials, and commodity miners/producers tend to perform during periods of inflation.

As for the question of raising interest rates, if the economy is going to be strong post-COVID, then if not now then when?

The Market Likes to Worry!

The voices in the market have been complaining that the Fed has kept rates too low for too long. Now that the Fed may be indicating two hikes two years out, the market is still not happy.

Not long ago there were fears of deflation and negative interest rates. Now that there is some inflation, “oh no now there’s inflation”.

Low wages and income inequality were also long-standing concerns. Post-COVID, wages have picked up, and now wage inflation is a concern.

The market likes to worry. It doesn’t matter if the chatter is inconsistent.

The Effects of an Infrastructure Plan

The path of the Fed is also likely to be dependent on whether an infrastructure plan is approved by Congress. Continued fiscal support would allow the Fed finally to reduce monetary stimulus.

If there is a transition from monetary to fiscal stimulus, it’s unclear how the markets will react. If economic growth and fiscal stimulus do happen and the Fed reduces bond purchases, we should see a steeper yield curve. A steeper curve would be stimulative to the economy as it gives banks an incentive to lend.

This leads me to another market complaint – the Fed is the only game in town. We’ll see if that holds true.

Thanks for reading. If we can help you answer investing questions, don’t hesitate to contact us.

The Pendragon Capital Management Team

Click to Download the June 2021 Newsletter

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

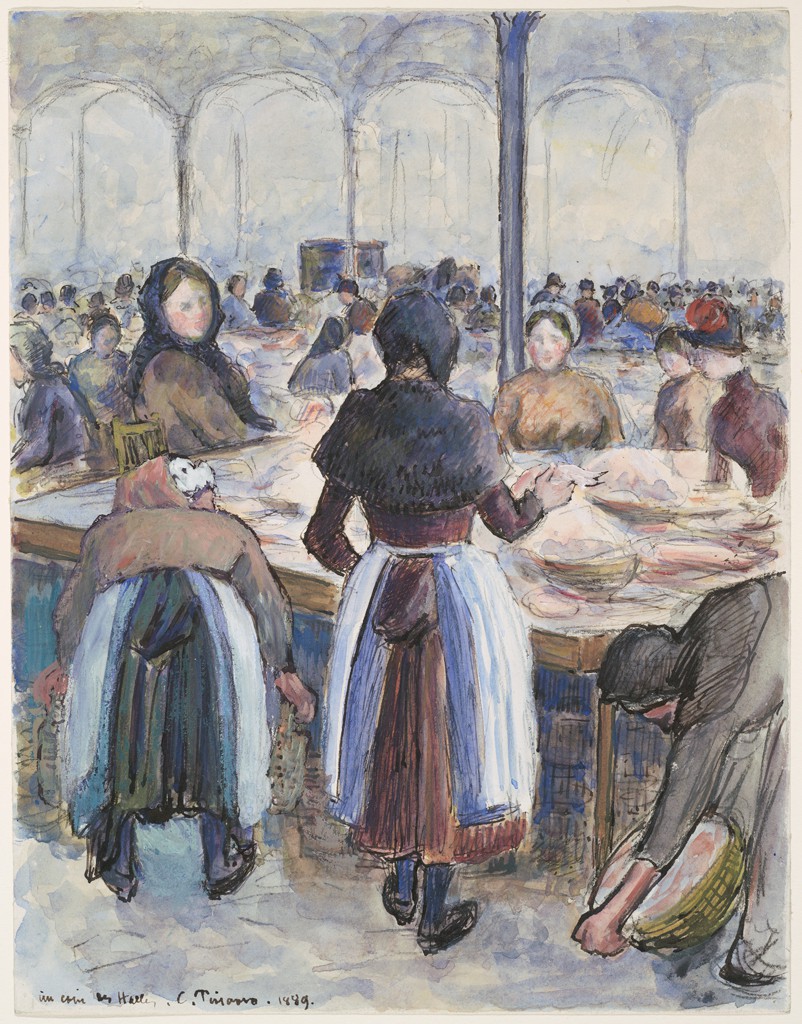

Image Credit: Camille Pissarro, Danish (St. Thomas, Danish W. Indies (now U.S. Virgin Islands) 1830 – 1903 Paris). The Market Place 1889 https://hvrd.art/o/297848