Stocks are up, and bond rates are low, making volatility front and center for investors.

The market seems to have no memory from one day to the next. On Thursday, July 8 stocks dropped on fears of the Delta COVID variant only to rally on Friday.

>> To subscribe to this monthly newsletter, click on Subscribe!

So Much Information for Markets to Digest!

The stock market has a lot to digest – COVID variants, political deadlock in Washington, higher commodity prices, Fed tightening, and second-quarter earnings about to be released.

Markets always have a lot to worry about. However, it is one thing when stocks are trading at low multiples and another when the market is trading where it is now at 26 times earnings. At lofty multiples, there is not a lot of cushion and prices are vulnerable to sharp sell-offs.

No one wants to be stuck “holding the bag.” Some of this quick-to-sell attitude is justified but some of it I would suggest is the result of the residual effects of the 2008 financial crisis, amplified by cable TV. A large down day is described as if it is undeniably the start of a deep bear market.

Stocks Are Up, At New All-Time Highs

Despite all the recent worry, stocks are making new all-time highs. With new highs, it’s hard to see an end to this bull market.

While Bond Rates Fall

Market action is often a strong tell. The news was flooded with reports of run-away inflation and the inevitability of Fed action to raise rates. The bond market ignored all of that. Rates actually FELL, with the 10-year Treasury going to 1.25% and the 30-year T-bond below 2%.

What Is the Market Telling Us?

Does “Mr. Market” know best and inflation is really not a problem? We’ll see.

Similarly, with stocks hitting new highs, is Mr. Market telling us that 2nd quarter earnings will be good and that the economy is in the midst of a strong recovery?

Large Earnings Growth Estimates

According to FactSet, Q2 S&P500 earnings are estimated to grow 64% from a year ago (the large comparison is due to last year’s COVID shutdowns). This is the largest growth estimate in more than a decade. Expectations have been increasing. So far, 37 companies in the index have issued negative guidance while 66 have increased guidance, the highest number since FactSet began tracking in 2006.

Energy Sector Earnings Estimates

If you are watching oil and gasoline prices, it is not surprising that the energy sector has seen the largest increase in earnings estimates.

Positive Earnings Revisions for Apple and Microsoft

The biggest market cap stocks, Apple and Microsoft have both had positive earnings revisions. If the two beat estimates, it will certainly help to keep the bull market going.

Treasury Bonds Have Been Volatile

The moves in the 10-year US Treasury rate have been fascinating.

At the end of March, as vaccinations were underway and there was talk of a broad infrastructure program, rates moved up to 1.77%.

The conventional wisdom held that a re-opening economy, accompanied by inflationary pressures would move rates towards 3%. Last week the 10-year rate went the opposite direction, hitting 1.25%, and closed the week around 1.35%.

Treasury bonds which are considered to be “safe money” have been rather volatile. From December 31, 2020, to the low on March 18, 2021, the exchange-traded fund, TLT which represents the 20+ Treasury bond fell 15% in value. As rates fell from the March highs the TLT has rallied almost 10%.

What Do Such Price Movements Suggest?

What can we infer from such price movements? Bonds rally (and rates decline), generally, as investors seek safety and/or when investors expect the economy to slow.

Conversely, bond prices fall when investors believe the economy will be strong and/or there is an expectation of inflation. While there is always a difference of opinion that motivates buyers and sellers to make markets, recent price moves in the bond market that are sharp and reverse in such short time frames make one question what is going on.

Is it possible that traditional messages that are sent from the markets are being distorted?

Perhaps the ubiquitous use of computerized and algorithmic trading moves prices regardless of any fundamental view of the economy. Programs move prices to an extreme only to snap them back to the other side of the boat. If this is true, then it is difficult to trust the bond market as a signaling mechanism for the future path of the economy.

One might make a case that in addition to computers, active central banks are creating similar conditions. If central banks massively buy to accomplish policy goals, it may not be the markets signaling but rather the central bankers.

Complicating matters further is a bond market that is at extremely low rates. In some parts of the world, rates are still negative. As is the stock market at high multiples, bond markets at very low rates are volatile.

Thanks for reading. If we can help you answer investing questions, don’t hesitate to contact us.

The Pendragon Capital Management Team

Click to Download the July/August 2021 Newsletter

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

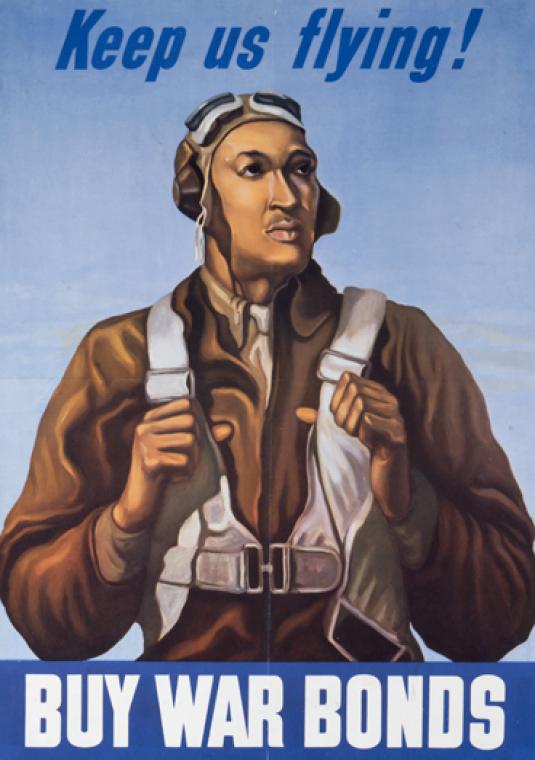

Image credit: Keep us flying! Buy War Bonds, Poster Collection, Created: 1940 – 1945 (Approximate), Schomburg Center for Research in Black Culture, Art and Artifacts Division