How familiar are you with Preferred Stock?

Preferred stock is a class of securities that is often overlooked by investors. It deserves consideration because preferreds have the characteristics of both fixed-income and equity securities.

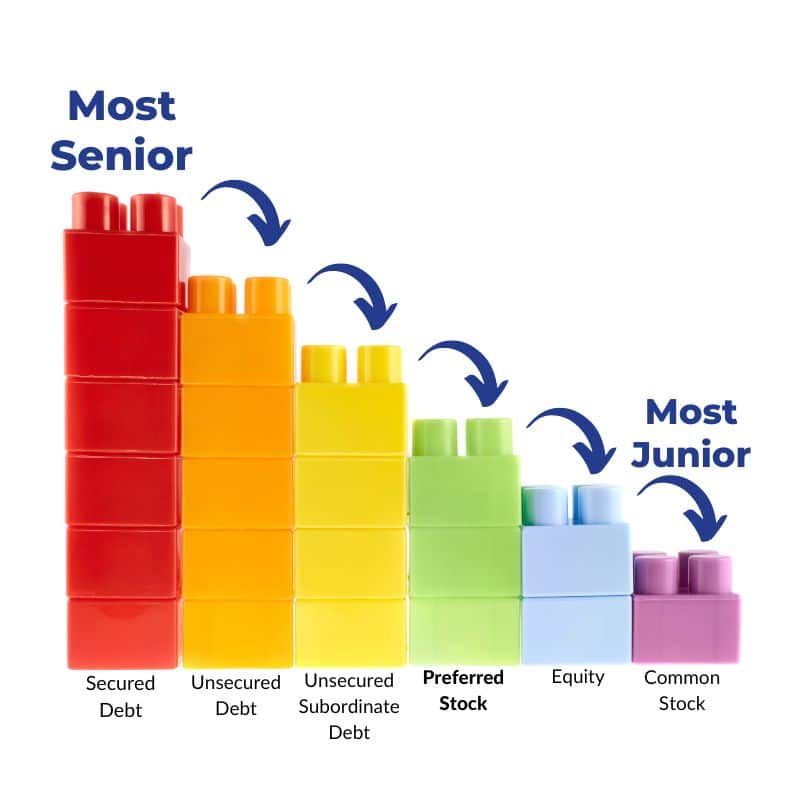

Preferred Stock in a Traditional Corporate Capital Structure

In the capital structure, preferred stock is junior to company debt (bonds) but senior to common stock. Here is how that looks in a traditional corporate capital structure:

- Secured Debt (highest priority for distributions in a bankruptcy)

- Debt Unsecured Debt

- Unsecured Subordinate Debt

- Preferred Stock

- Equity

- Common Stock (most junior claim in a bankruptcy)

In a liquidation such as bankruptcy, the secured debt has the highest priority for distributions, and from there the creditors would be in position down the “waterfall” until Common Stockholders who have the most junior claim. Even if the company is a going concern, the cash generated from operation first goes to pay taxes and employees, followed by interest owed to bondholders.

Preferred stockholders’ position in the equity of the firm’s capital structure is just ahead of the common stockholders who are the last to get paid. Unlike common shareholders, though, preferred stockholders do not get to vote on company matters.

Priority Over Company Dividends for Preferred Stockholders

Typically, preferred shareholders have priority over company dividends.

If a company suspends its dividends, common shareholders cannot receive dividends until the preferred shareholders receive their dividends. In many cases, preferred stock is “cumulative” meaning that if a company suspends preferred dividends, all back dividends will be payable to holders.

Additionally, common shareholders cannot receive dividends until preferred stockholders receive all their dividends that might be in arrears. If the preferred stock is “non-cumulative”, there are no arrears, and dividends missed are not repaid. In most instances, preferred holders still need to get their dividends before common shareholders can receive their dividends.

Preferred Stock Fixed Dividend

Preferred stock usually pays a fixed dividend, stated as either a percentage of par value or a specific dollar amount that is higher than the dividend on a company’s common stock. Most preferreds have a $25 par value per share. Sometimes this is called face value.

The fixed dividend is one of the characteristics that is like fixed income instruments such as bonds. The fixed dividend feature, like a bond, makes the value of a preferred stock dependent on interest rates. Preferreds have no or very long-dated maturities therefore their value is even more sensitive to changes in rates. However, because preferred yields are typically higher than those of bonds, the higher spread offers some buffer to the impact of rates.

Issuers Can Call Preferred Stock in on Specific Dates

Many preferreds can be called in by their issuers at face value on specific dates. Investors need to be careful if paying more than face value as the preferred could be called face causing a capital loss.

Firm’s Credit Quality Tied to Preferred Stock’s Price

Given their position in the capital structure, changes in a firm’s credit quality can also create large movements in price. An interesting fact is that, according to Infracap Advisors and Moody’s, despite preferreds being lower than bonds in the capital structure, preferreds have a much lower default rate when compared to high-yield (“junk”) bonds. This may be because for investors to be interested, only higher credit quality companies can sell preferred stock to investors.

Risk and return go hand-in-hand. On December 31, 2022, the yields on various instruments reflect the priority of cash flow and credit quality. The data is from Bloomberg LP.

- US Treasury Index 4.18%

- US Corporate Investment Grade Index 5.42%

- US Preferred Stock Index 5.99%

- US High Yield Index 8.96%

One might assume that preferred stock should have a higher yield as it is lower in the capital structure than debt but, as mentioned previously, preferreds are typically issued by higher quality firms than companies that issue junk bonds.

The Complexity of Preferred Stock

Preferred stocks have a place in investors’ portfolios but are complicated instruments.

While we have discussed most of the nuances and features of preferred stocks, there are still more “flavors” and features like:

Convertible Preferreds

Convertible preferreds allow holders to exchange their preferred shares for common shares at a fixed exchange rate.

When he is rescuing a company, Warren Buffet likes to use convertible preferreds. The company issues a special class of convertible preferred to Buffett’s Berkshire Hathaway. Buffet likes these instruments because he gets a high dividend while he waits for the company to improve whereby he can benefit from an appreciation in the companies underlying value.

Most recently Buffett financed Occidental Petroleum’s takeover of Anadarko in exchange for a convertible preferred stock issued by Oxy.

Floating-Rate Preferreds

Floating-rate Preferreds are where the dividend floats based on a rate index like SOFR plus a spread. There are some floating-rate preferred issues that pay a fixed dividend for a certain period and then after that date pay a floating dividend.

What to Understand About Preferred Stock

In the end, investors need to understand:

Credit Risk

Often the credit rating agencies do not rate preferreds and investors are on their own.

If a company stops paying preferred dividends, investors may need to wait a long time for dividends to be restored. Not all issues will pay dividends accumulated in arrears.

Interest Rate Risk

Rising rates put downward pressure on preferred stock prices.

Call Risk

Many preferred stocks issued have call provisions and the shares can trade at a negative yield to call.

Investing in Preferred Stocks

Professional money management can be helpful when adding preferred stocks to one’s portfolio. You’ll find open-end mutual funds, closed-end funds, and ETFs that invest in preferred stock. Using funds also provides investors with diversification. Banks, insurance companies, and utilities are the largest issuers of preferred stock.

Here’s a discussion from VirtualBankConference.com with Jay Hatfield about bank-preferred stock that you may find helpful. He is CEO of Infrastructure Capital Advisors and is the portfolio manager of the InfraCap Equity Income Fund ETF (NYSE: ICAP), InfraCap MLP ETF (NYSE: AMZA), Virtus InfraCap U.S. Preferred Stock ETF (NYSE: PFFA), InfraCap REIT Preferred ETF (NYSE: PFFR) and a series of hedge funds.

As with many investments, it’s important to have exposure to many issuers and industry sectors to offset stock-specific and industry risk.

Thank you for reading. If you enjoyed the content, please share it with your contacts. Don’t hesitate to reach out with any questions.

Thanks for reading!

>> Schedule a Complimentary Investor Consultation <<

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.