December 2022 was a bad month for stocks and bonds.

The S&P500 fell 5.9% for the month. As measured by the intermediate corporate ETF, LQD, bonds were down 2.2%. A combination of uncertainty over rates and recession as well as a particularly aggressive tax-loss harvesting season hurt securities.

>> To subscribe to this monthly newsletter, click on Subscribe!

An Investor’s Best Advantage: Time

I would argue that in times of stress, the weaknesses in the current market structure lead to fierce one-way movements. Algorithmic trading, no specialists to insure orderly markets, leverage in the system, and complicated hedging strategies are among the factors that influence the volatile market moves we have seen over the past two decades. Investors need to deal with these realities.

However, one advantage that investors have is time. Many of the forces at work in the market are short-term oriented. This means that opportunities open up for those who can identify dislocations and irrationalities and can take action and be patient.

When investing, one has to be prepared to ride out the bumps along the way in order to benefit from the long-run positive returns. Look at a long-term chart of the market. It moves from the lower left to the upper right. Big negative events like the 1987 Crash are barely visible today on a typical graph.

>> See Why Staying Invested Is So Important For the Long Run

2022: A Bad Year for Stocks and Bonds

2022 was a bad year for bonds too. It’s unusual for stocks and bonds to both be down big in the same year. Inflation and rising rates are not good for both stocks and bonds.

The aforementioned LQD was down 17.9%. The 20+ year Treasury ETF, TLT, was down 31%. There were few places to hide in 2022.

Opportunities Among the Wreckage?

With the Russia-Ukraine situation, energy was a star performer. So where could there be the opportunities among the wreckage?

Of course, a lot will depend on the economy and geopolitical developments. If inflation eases off, the Fed slows rate hikes, recession fears abate and there are no escalations or new global crises, 2023 could be a good year for stocks and bonds. That is a long list of items to break into the good but it is not inconceivable.

Already, recent economic reports are indicating a moderation in inflation and a slower economy but a still ok employment picture.

Sentiment is negative. In the past year, money has consistently been pulled from the markets. A lot of bad news already might be priced in. Flows can turn quickly.

2022 is in the books. 2023 is what is important. We will get earnings reports this month that will tell us a lot about the economy and give more clues about business conditions

Upgrade Portfolio Income Streams

The market decline in stocks and bonds is providing investors with the opportunity to upgrade the income stream that their portfolios generate.

A lot of companies, despite the market, increased their dividends in 2022. Many solid companies, due to their stock price falling, now have very attractive dividend yields.

Similarly, in the bond market, short-term US Treasuries yield over 4%. It is not uncommon to find good-rated corporates and munis with nice yields too. Historically, dividends and interest comprised about 1/3 of a portfolio’s total return.

In the early 2000s, growth became fashionable and the Fed kept interest rates low so yields became less of a focus. Now, that has changed. If the yield gives you 3% or 4%, you don’t need as much in the way of capital appreciation to get a good return.

The Long-term Average Return for US stocks is Around 7%

Remember, the long-term average return for US stocks is around 7%. Today, dividends almost get you half the way there. While I think there are reasons to be optimistic for both stocks and bonds in 2023, there are some unresolved issues that could continue to present an overhang for investments.

The Crypto Meltdown

The crypto meltdown does not appear to be over. It seems like while no one was looking, vast amounts of leverage crept into the crypto space.

Worse, there may not be enough (or any assets) to collateralize this leverage. If not, there is no residual or recovery value for crypto holders. Those crypto owners will have to sell other assets (like stocks and bonds) to cover their borrowings.

Leverage Everywhere

The zero-rate environment allowed for leverage everywhere. Companies borrowed at low cost, often with few covenants. If debt needs to be paid and rolled over, certainly the cost is higher today and lenders are not so easy.

With the Fed now tightening, there is less money to go around. Companies that need money might have problems getting it or will have to pay up for it.

For 2023, Focus on Portfolio Quality

Portfolios in 2023 should focus on quality. I think solid companies will be rewarded with better stock prices. Speculative positions should be kept small and balanced with quality.

Thanks for reading. Don’t hesitate to reach out if you would like to further discuss the markets.

>> Download the January 2023 Newsletter <<

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.

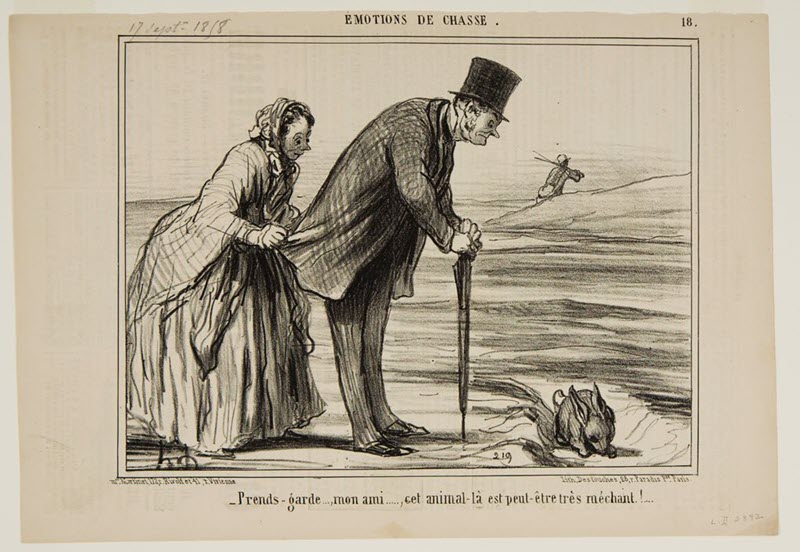

Image Credit: Honoré-Victorin Daumier, French (Marseille, France 1808-1879 Valmondois, France), “Careful…my friend…that animal may be a bad one!” Book Title: Emotions De Chasse, pl. 18 (“Le Charivari,” 17 September 1858), https://hvrd.art/o/269925