Do you believe in staying invested, regardless of the market’s ups and downs? We hope you do. We’ll explain why in this article so you feel more confident about the benefits of being and staying invested for the long run.

Long-Term Investing Tips Odds in an Investor’s Favor

The most important concept for investors to appreciate is how time is an investor’s best ally. Time tends to flatten the wild ups and downs of the market.

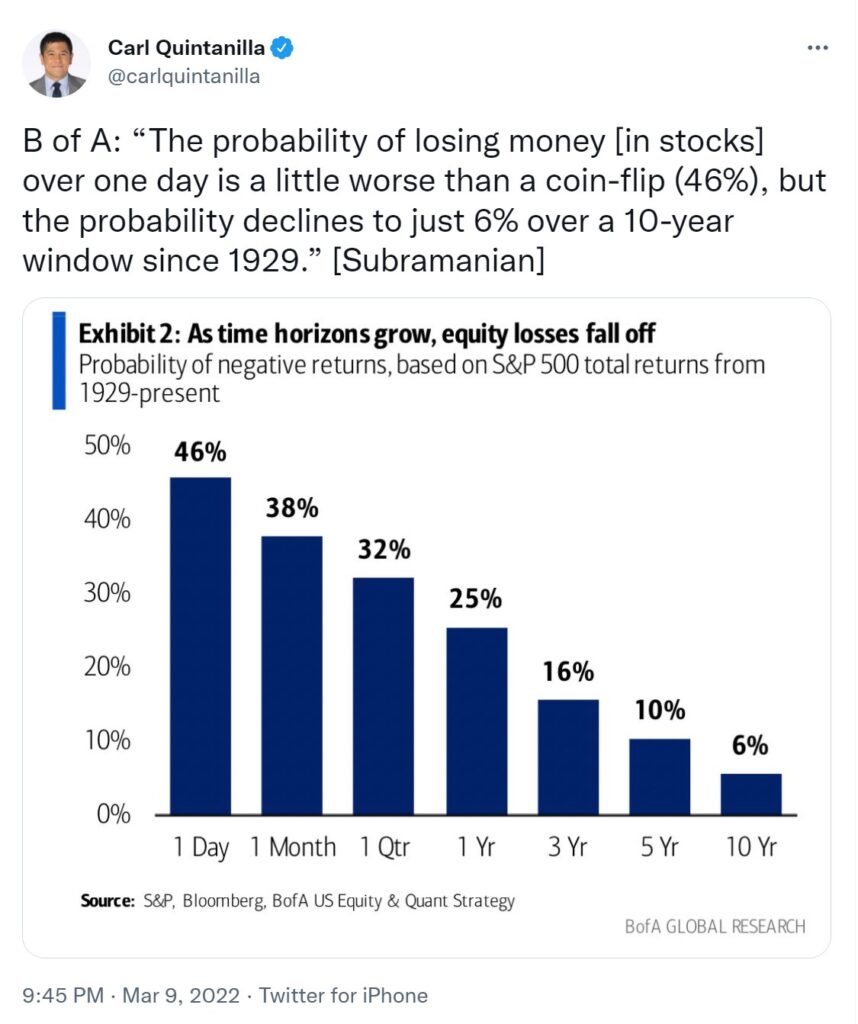

This chart posted on Twitter by Carl Quintanilla succinctly captures this concept.

The chart shows the importance of long-term investing. In fact, being a long-term investor in a diversified portfolio such as the S&P 500 is analogous to counting cards at a blackjack table. Long holding periods for a portfolio tip the odds in investors’ favor.

According to BofA Global Research, since 1929, the probability of a negative return in the S&P500 over any 10-year holding period is just 6%. This is remarkable.

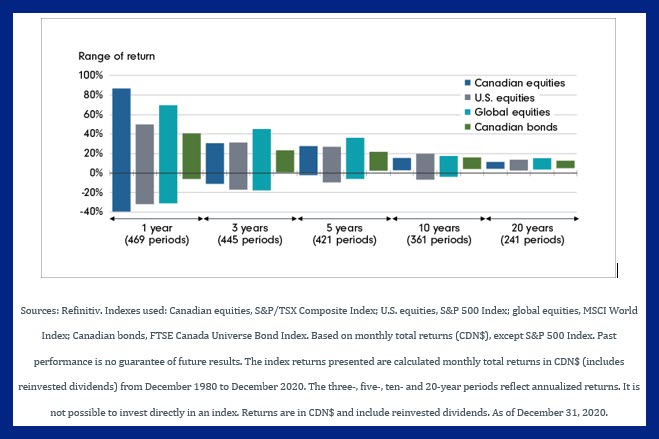

Three charts on the benefits of staying invested offers another perspective. Looking at different types of investments, the chart below compares the highs and lows of investment timeframes from December 1980 to December 2020.

Notice how the shortest investment period (one year) on the left exhibits significantly more extremes than the longest timeframe (20 years). In other words, long-term investing tips the odds in an investor’s favor. For that reason alone, you should stay invested.

Market Fact: There’s Always Something For Financial Markets To React To

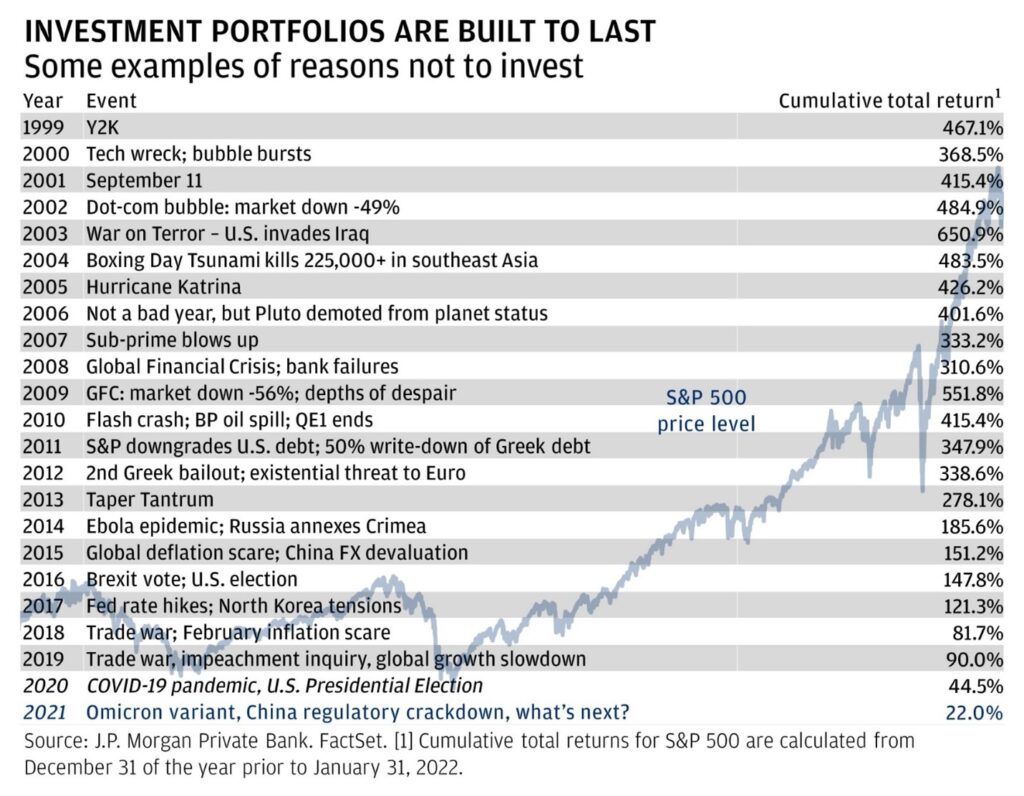

As much doom and gloom as the media and financial markets focus on, a sobering fact helps put into perspective the ups, downs, and general volatility.

That fact is that the only constant – literally – is change. Like an eager puppy, the market gets easily distracted by the latest newest issue – whether that’s a war, a weather event, a market crash, or a pandemic. And, despite all those terrible scenarios, the market in the long term tends to reward investors who stay constant and invested.

The chart below from The case for (always) staying invested makes that point. As you can see, each year – except for 2006 when Pluto got demoted – features rather grim happenings. And yet, had you been invested for the long haul, your cumulative total returns would have been remarkable.

Three Rules for Surviving Market Volatility

Given the constant nature of change, here are three rules for surviving such intense volatility.

>> For additional perspective, read Market Volatility, Expectations & the Global Markets

Rule 1: Diversification

Along with having a long time horizon, you should take diversification very seriously.

Diversification refers to the following:

- Industry sectors

- The types of financial instruments included in your portfolio

- The types of companies you invest in.

For that reason, you’ll find articles in the Pendragon Capital Management Insights Blog about different sectors – such as climate, energy, and green investing – and industry segments – such as Banks. Why? Because diversification is important.

Given market volatility, you want to keep perspective and understand that if you hold a diversified portfolio of stocks with a long-term horizon, the chance of losing money is relatively small.

Rule 2: Have a Financial Plan and Stick to It

Having a financial plan is critical. That’s why you’ll find regular reminders (see 9 Financial Resolutions for the New Year) to do so if you haven’t already, and to revisit your plan regularly if you have. A plan keeps you focused, and able to avoid reacting emotionally to the market’s volatility. It also forces you to understand your investing risk tolerance.

As a young investor, you have a long runway until you retire, and you should welcome downturns in the market as it provides an opportunity to buy at reasonable levels and reap larger rewards down the road.

>> See Always Look for Investing Opportunities

>> See How Much Money Do You Need to Retire? about the value of starting early.

Older investors, those close or in retirement without new money to invest, will need to make sure their portfolios are durable and that drawdown risk is managed. At the same time, they shouldn’t run away from having stocks in their portfolios to balance inflation and lower-risk assets earning low returns.

As always, an individual’s situation varies from person to person and one’s asset allocation should reflect needs and objectives. However, with time, the risk of losing money to that portion of one’s portfolio is lower.

Rule 3: You Can’t Time the Market

Finally, as an investor, it’s vital to accept that you cannot time the market. By moving in and out, based on your perception of when the market is performing best and worst, you may miss the best days.

For perspective, if you were fully invested from January 1986 to December 2020 with $10,000 you would earn $150,624. If you miss the 10 best days, your investment would be worth $48,818, and $7,164 if you missed the best 40 days. (See Three Charts on the benefits of staying invested.)

>> Here’s our take on that: Don’t Try to Time the Market; Just Invest

Please Commit to Staying Invested!

Do you feel more confident about staying invested for the long term? If not, why? Please don’t hesitate to reach out with questions.

Thanks for reading.

Subscribe to Pendragon's Newsletter

Image credit: Portrait of Edwin vom Rath’s Pug, Conradijn Cunaeus, c. 1880 – c. 1895, Rijks Museum

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.