Welcome to the Pendragon Capital Management Guide to Green Investing.

Green or sustainable investing is something we care intensely about. In fact, it’s why we created the Climate Impact Portfolio. Investors need a sound investment strategy and expertise to evaluate, and select investments, and manage risks in this new world of environmental technologies, business models, and rapid change.

There are many green investment products, many of which are “cookie-cutter” approaches to green investing. Greenwashing is one of the issues investors must be aware of when seeking honest, effective investment management, that’s good for the planet and your portfolio.

Consider this guide a trusted companion as you become immersed in green investing.

Pendragon Capital’s Green Investing Guide Table of Contents

We’ve organized this guide in the following segments. Feel free to read through programmatically or jump to sections of interest by clicking on the relevant links.

1. ESG and ESG Investing

2. ESG vs. Green Investing

3. Types of Green Investing

4. Why Embrace Green Investing Now?

5. What’s the Long-Term Outlook for Green Investing?

6. How to do Green Investing?

7. Final Thoughts

>> Download this Green Investing Guide as a PDF <<

1. ESG and ESG Investing

When considering green investing, you’ll quickly come across the term ‘ESG.’ That’s because green investing is part of the overall movement towards ESG investing.

ESG stands for Environmental, Social, and Governance issues and is meant to consistently consider those issues and risks as an integrated component of your overall investment strategy. Paying attention to a company’s ESG score allows an investor to develop a more ethical portfolio.

Environmental

Environmental in ESG considers how a company uses its resources and attempts to limit any negative environmental effects and protect the environment. For example, some aspects in this category include water usage, carbon emissions, pollution, deforestation, waste disposal, and recycling.

Social

Social looks at how a company treats employees, suppliers, customers, and the communities they influence.

A company may be evaluated in human rights, gender diversity, employment and pay equality, sexual harassment, health and safety standards, employee relations, data security, and labor conditions.

Governance

Governance reflects how a company determines and establishes the policies and procedures that it has chosen to follow. This may include diversity, business ethics, executive compensation, lobbying, political contributions, as well as bribery or corruption for the company and the company’s board.

Studies have shown that companies with highly rated ESG practice may carry less risk and may perform better (sources: Standard + Poor’s Global Market Intelligence, April 13, 20202, and the Financial Times, April 3, 2020).

The Perils of Focusing on Subjective Investment Measures

As the article Environmental, Social and Governance (ESG) Investing and How to Get Started states about sustainability,

“Unfortunately, the arena of “sustainable” has a lot of gray areas. ESG, or environmental, social and governance investing, is looking to change that. ESG investing uses particular criteria to grade investments in an attempt to clarify exactly what sustainable should look like.”

Ideally, by examining a company’s ESG performance, an investor can determine whether the financial returns do harm or good from a sustainability perspective.

The devil, though, is in the detail and fully understanding what’s included or excluded in the final score, and whether you can truly compare one ESG score to that of another company. This is particularly true for the social and governance elements which are more subjective and basic than the environmental ones.

As with any kind of investing, do your research so you can evaluate whether ESG practices are thoroughly embedded in how the company operates or simply for show.

2. ESG vs. Green Investing

As mentioned above, ESG has shortcomings. Or, rather, the S and the G in ESG have shortcomings because they are more subjective than the E, and fall more easily into greenwashing territory.

For that reason, some investors choose to favor green investing over ESG investing, so they can focus on investments that support the environment.

Your Guide to Green Investments explains that,

“Green investments are investments in companies, government entities or supranational organizations that support environmentally friendly practices. Those practices may include natural habitat preservation, green building, water conservation and production or distribution of renewable energy. Green investing is often associated with socially responsible investing (SRI), though SRI extends to more than just environmental causes. There are different ways to promote green investing in a portfolio, including investing in individual stocks as well as exchange-traded funds (ETFs), mutual funds and green bonds.“

When considering green investments, you’ll find options where green practices generate most of the revenues while in other cases green activities may be a minority that is ramping up to eventually replace non-green. The common element is a commitment to sustainability:

“In a general sense, it’s a commitment to supporting green practices. So, for example, a company that only relies on renewable energy sources and is actively engaged in water conservation may fit the bill for green investment. Likewise, a real estate investment trust (REIT) that only invests in properties that have environmentally-friendly upgrades or improvements may be an attractive target for eco-conscious investors.“

By the way, just because entities commit to sustainability doesn’t mean that green investing is free from green-washing. As with any kind of investing, you must do your due diligence to fully understand what you are investing in.

>> See A Guide to Greenwashing and How to Spot It

3. Types of Green Investing

When you’re ready to get started with green investing, you’ll have several different types of green investments available that we’ve grouped into renewable energy and managing resources:

Renewable Energy

Renewable energy is a critical sector in green investing and includes the following sources of energy:

- Solar energy

- Wind power

- Hydropower

- Geothermal Power

- Biofuels

Managing Resources

In addition to developing new energy sources that aren’t fossil fuel-based, green investing looks to improve how current resources are managed. More specifically,

- Protecting the air and combating pollution

- Ensuring sustainable food production

- Dealing with waste and recycling

- Conserving water

- Preserving and protecting wildlife habitat

- Mitigating climate change

- Developing green building practices

>> Download this Green Investing Guide as a PDF <<

4. Why Embrace Green Investing Now?

Momentum is finally building around protecting the environment and managing a world where global warming is real. That recognition means that new industries are expanding and forming at a rapid pace, rethinking existing technologies and imaging completely new ones.

Pendragon Capital Management believes in green investing and the transition from fossil fuels to green, renewable energy. We’re here to help you participate.

Given that momentum, green investing allows you to make a positive impact on the planet while earning positive returns.

Let’s explore these factors in more detail.

Climate Change Imperative:

The climate change imperative is fully underway with pressure building on those locations that haven’t taken any environmental actions. At the same time, investment capital is flowing into greener companies and away from fossil fuels in a trend that is unlikely to reverse.

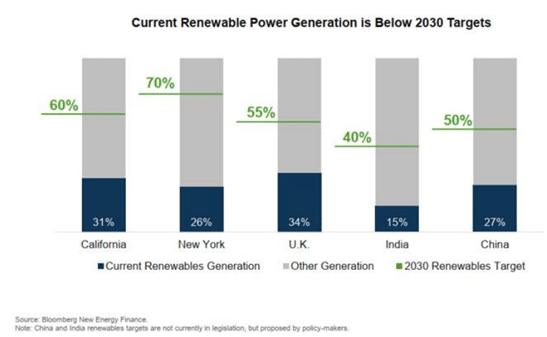

Many states and countries are significantly behind on their goals for renewable power. New York alone has only accomplished 26% of its renewable energy goal. Consensus is strong for actively addressing climate change especially by corporate entities, major US states, key Asian countries, and importantly Europe.

>> See The Paris Agreement

>> COP26 UN Climate Change Conference

The rise of ESB screening by asset managers and capital allocators is channeling marginal investment capital flows into greener companies and away from fossil fuels producers.

Technology:

From a technology perspective, momentum is also building.

Clean energy costs have decreased significantly over the last 10 years:

- Solar costs are down 83%

- Onshore wind farm costs are down 50%

- Batteries are down 85%

- Electric vehicles are expected to reach cost parity with gasoline-powered vehicles around 2024.

When costs go down, it’s easier for cleaner energy to replace traditional sources. Adoption rates can increase significantly.

Economic Viability:

Lower green energy costs and cost structure improvements mean that economic viability for renewable energy is at a tipping point. Renewables have been brought to grid-parity pricing in many locations. For example, in Australia, China, Germany, India, UK, & portions off the US, renewables offer the same or lower unsubsidized power costs (LCOE) as newbuild fossil fuel or nuclear plants.

Shift in Political Attitudes:

Finally, political attitudes have shifted dramatically with the 2020 US election being a watershed moment for climate companies. It brought a shift in Federal policies whose long-term effects have not been fully priced into the market.

UN Climate events have highlighted the momentum building in the EU, especially Germany, India, and elsewhere.

Supporting companies that improve prospects for a sustainable future is critical to the transition to a lower carbon emission world.

5. What’s the Long-Term Outlook for Green Investing?

The long-term green investing outlook is strong in the United States and around the world.

European green efforts are well underway. EU parliament elections in 2019 saw significant gains by the Greens, as have regional elections in Germany and elsewhere. Corporate announcements continue to highlight the momentum as does the European Green Deal implementation.

At the same time, current renewable power generation is well below 2030 targets indicating significant opportunity for growth in this sector.

These changes are propelling green energy companies to above-market EPS growth rates.

Crucial to mankind’s survival on planet Earth is figuring out how to accelerate the complete transition to renewables.

>> See The Renewable Energy Investment Landscape

6. How to Do Green Investing?

If you’re serious about becoming a green investor, you would embrace a green portfolio that seeks out opportunities in green companies focused on making clean energy and technology more apparent and accessible. That would enable you to positively impact climate change while generating positive investment returns.

Options for your portfolio would include:

- Direct Investments in Renewable Energy Projects

- Green Mutual Funds & Exchange Traded Funds

- Actively Managed Separate Accounts

- Purchases of Individual Company Shares and Bonds

Support the Green Energy Transition

The global energy transition away from fossil fuels over the next 20 years is critical to mitigating climate change. It is also creating exciting opportunities to generate attractive investment returns and support companies that are improving the prospects for a sustainable future.

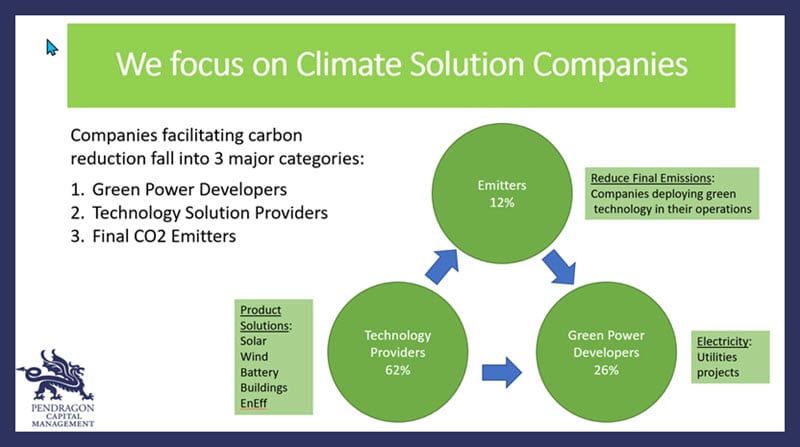

The approach the Pendragon Climate Impact Portfolio takes is to use a fundamental bottom-up process combined with detailed industry supply-demand balances to find the companies that are truly making an incremental difference in CO2 emissions and can offer solid investment and social returns.

Note that this portfolio is neither an automated quant fund nor a passive index product. And live experts (rather than robo advisors) actively manage every aspect of portfolio management.

You’ll find numerous opportunities to generate alpha using fundamental investing criteria to find the best companies facilitating the energy transition, and actively trading them as their prospects and valuations change over the green business and macrocycles to maximize returns.

The focus is on Climate Solution Companies that facilitate carbon reduction.

Green Investing Guide Final Thoughts

Green investing takes careful research. If you aren’t comfortable managing the process on your own, consider speaking with a financial advisor.

When you work with a professional investment manager, you have the benefit of someone who can actively work with you, so you understand the benefits and complexities of this investment sector while rigorously managing the portfolio.

Pendragon Capital Management believes in green investing and the transition from fossil fuels to green, renewable energy. We’re here to help you participate.

Thank you for reading.

>> Download this Green Investing Guide as a PDF <<

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.