Earnings play an important role in guiding investors, particularly during difficult markets.

With markets nervous about stubborn inflation, a gradually slowing labor market, and the timing of the first Fed rate cut, investors are more focused on this corporate earnings season than usual. This is because while the economy has avoided a “hard landing” corporate earnings only began to rebound in the second half of 2023. Since the stock market tends to follow the trajectory of earnings in the long run, many investors are hoping for signs that corporate profits will grow sustainably in the coming quarters.

What do investors need to know today about how earnings might impact the stock market and economy?

Positive First-Quarter Earnings Trends

With 92% of S&P 500 companies having reported their first-quarter earnings results, the trends are positive. According to FactSet, 78% of large-cap companies had positive earnings-per-share surprises last quarter which is better than the 10-year average. Blended earnings growth is coming in around 5.4% year-over-year, the highest in almost two years, making this the third straight quarter of earnings growth.

Strong Consensus Estimate for 2024 Earnings

On a full-year basis, the consensus estimate for S&P 500 earnings in 2024 is now $239 per share according to LSEG data. If this is achieved, it would represent a 10.2% increase from last year. Wall Street analysts also expect continued growth of 14.0% and 11.7% in 2025 and 2026, respectively. The hope of an earnings rebound is one reason the stock market has rallied over the past year, driving up valuations.

Thanks in part to steady earnings growth, the S&P 500 is now only about half of one percent below its all-time high. In this environment, there are three key points long-term investors should keep in mind.

Earnings growth supports the stock market over time

First, while investors focus a great deal on topics such as inflation, the job market, and GDP, investors do not directly invest in the economy. Issues such as the impact of higher interest rates, a slowdown in the labor market, or a “hard landing,” affect investors through the financial performance of companies. In turn, this affects stock prices which then impact the overall market and investor portfolios.

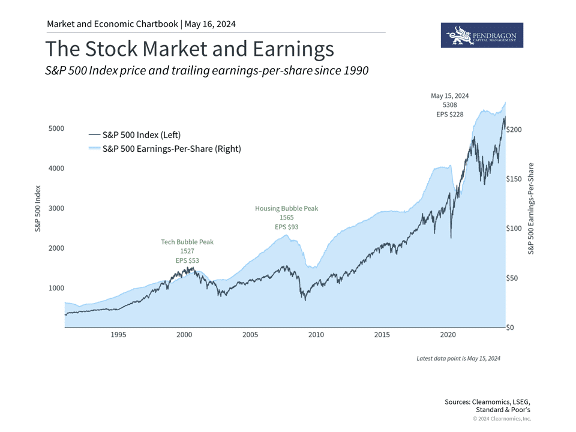

The accompanying chart shows that while they do not mirror each other exactly, there is a strong relationship between corporate earnings and the stock market. The stock market tends to follow the trajectory of earnings, with differences between the two lines resulting from changes in stock market valuations and investor sentiment.

Economic Cycles Matter for Long-Term Investing

This is why economic cycles matter for long-term investing: when the economy is growing and consumers are strong, company sales tend to improve. Conversely, spending tends to slow during economic downturns, hurting corporate profits. For investors, focusing on these longer-run trends is far more important than trying to guess what the market might do over a day, week or month.

These dynamics can also impact how markets behave during pullbacks. If the market does experience a decline when the economy is otherwise strong, valuations will grow more and more attractive. Eventually, investors will find it appropriate to add to their portfolios, helping to stabilize the market. In contrast, market pullbacks are much more challenging when they are the result of economic challenges such as recessions. This is why bear markets have typically only occurred when there has been a significant recession or economic shock.

Earnings growth reached an inflection point last year

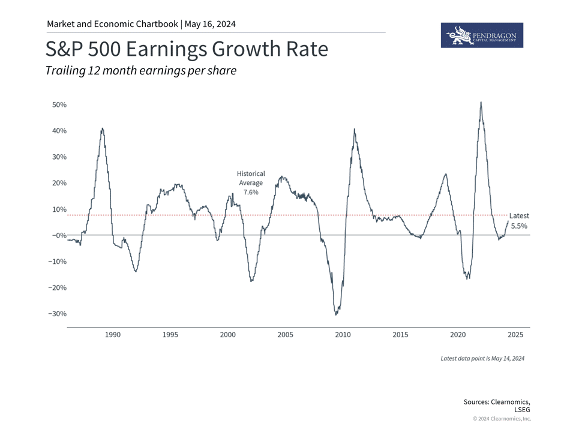

Second, as the accompanying chart shows, the growth of corporate profits reached an inflection point last year and has begun accelerating again after struggling in 2022. While the economy avoided a recession that year, the stock market did enter a bear market partly because there was an “earnings recession” among large-cap companies. While the historical average earnings growth rate is 7.6% since the mid-1980s, earnings growth tends to fluctuate in cycles tied to the business cycle and shorter-term industry trends.

Earnings growth rates also affect whether the stock market appears “cheap” or “expensive.” The price-to-earnings ratio, for instance, is simply the price of a stock or index divided by some earnings measure, such as expected earnings over the next twelve months. What this means is that even if prices don’t change, increasing earnings will make the market more attractive, and vice versa.

Of course, stock market prices have risen significantly over the past 18 months. The current S&P 500 price-to-earnings ratio is just under 20 times next-twelve-month earnings partly due to the strong bull market rally pushing up the numerator, and partly because earnings growth is only now supporting the denominator. So if earnings growth does continue to accelerate, valuation measures such as the price-to-earnings ratio could improve.

Economic fundamentals remain strong

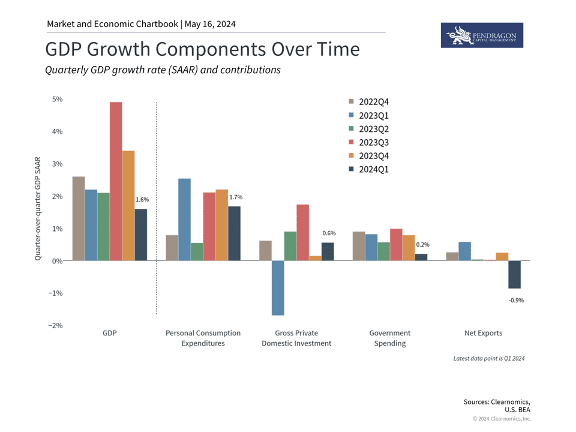

Third, concerns over a recession or “hard landing” have moderated in recent quarters.

According to FactSet, the term “recession” appeared in only 100 transcripts of earning calls of S&P 500 companies compared to 302 a year ago. This is the fewest number of mentions in two years and mirrors the improving sentiment across financial markets. Fed funds futures, for instance, are now anticipating mild rate cuts this year compared to the start of this year when many investors expected the Fed to cut rates rapidly in response to a possible recession.

Additionally, data from the Federal Reserve Bank of Richmond’s CFO Survey echoes this sentiment – optimism about the economy reached its highest level since the second quarter of 2021. Estimates by Chief Financial Officers for real GDP growth for the next year average 2.2%, up from 1.7% at the end of 2023. Only 10.1% of CFOs believe a recession will occur over the next year. While these projections are not always correct and are subject to change, they provide additional insight into how corporate executives view the current economic climate.

Latest Earnings Show Strong Company Performance

The bottom line? The latest earnings figures show that companies are performing well which is a positive sign in this uncertain market environment. In the long run, investors should focus more on trends around economic fundamentals such as earnings than on day-to-day stock moves.

>> Read Why Staying Invested Is So Important For the Long Run

Thanks for reading! Don’t hesitate to reach out with questions.

>> Schedule a Free Consultation with Pendragon Capital Management <<

Image credit: Landscape near Newport, RI, Smithsonian American Art Museum, Gift of Ronald E. Dealca. 1877-1878

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results.

Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property.

All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.