Have you calculated how much money you need to save for retirement? According to the Department of Labor, only half of Americans have done so, even though we will spend – on average – twenty years retired.

>> See Top 10 Ways to Prepare for Retirement (pdf)

Let’s explore the amount of money you’ll need to live as a retiree so that you can determine how much you need to save now to reach that amount in time. This is also a great conversation to have with your financial or investment manager.

The Sooner You Start Saving for Retirement the Better

The longer the timeframe you have available before retirement to set money aside, the more opportunity you give that money to grow in value.

>> See Don’t Try to Time the Market; Just Invest

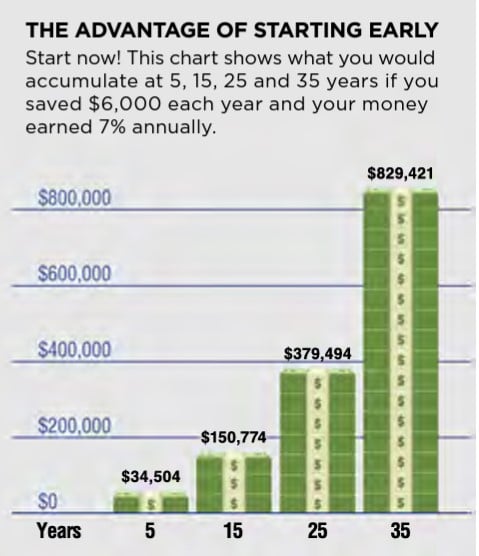

The chart below comes from the Department of Labor pdf mentioned above. It illustrates how much money you could accumulate over different time horizons by setting aside $6K per year, assuming it earned 7% per year.

At five years, you would have $34.5K compared to $829K after 35 years.

Imagine having an additional five years, and the $34.5K would become $150.8K, or even $379.5K after twenty-five years.

In other words, the sooner you start putting money aside for this savings goal, the better!

Determine Your Retirement Lifestyle

One of the challenges with trying to figure out how much money you’ll need when you retire is imagining the future and planning for all of the unknowns ahead including potential medical bills, long-term care, etc. That doesn’t even take into account how long you can expect to live.

For that reason, you’ll find it worth your while to explore different scenarios based on different models that you can then evaluate and use to determine a retirement goal amount. You’ll also want to make sure that you have a financial plan in place for your current lifestyle.

>> See 9 Financial Resolutions for the New Year

Translate Your Retirement Lifestyle Into Cost Assumptions

That said, what kind of a lifestyle do you envision for your retirement? Do you anticipate traveling the globe, moving to a different location, simplifying your life? How much debt do you think you’ll have to take care of?

Try to put detail around what that lifestyle looks like and translate the detail into cost assumptions. If you travel the globe, do you expect to take 2 trips per year each one lasting a month? Make assumptions about travel, lodging, food, and entertainment costs.

What Retirement Income Do You Expect?

What income can you count on once you retire?

There’s social security starting at a certain age. Perhaps you have a pension plan that will pay out when you retire? Do you want a part-time job? What about investment income?

What’s the Gap Between Your Costs and Income?

The difference between your retirement cost of living and your retirement income gives you a sense as to how realistic your vision for the future is, and how much you need to set aside now to enable that future.

Four Topics to Address Now

As you develop your retirement plans, take into consideration the following topics:

1 – Reduced debt

As you head toward retirement, consider what debt you can reduce or eliminate.

- Do you have a mortgage you can pay off before retiring so that you don’t have a house payment?

- Can you pay off credit cards or auto loans before your income is reduced?

Taking debt into retirement means you’re paying costs right when you retire as well as going forward, as debt interest continues to compound over time.

2 – Healthcare coverage

Even when people are still working full-time, medical expenses can wreak havoc on a household’s finances. As you get older, it’s likely your healthcare needs will increase, which means it’s important that your medical costs are covered.

Whether you are covered by your employer in retirement, rely on Medicare, or purchase your own health insurance, you’ll want to figure out what your out-of-pocket costs will be. Healthcare coverage can be a significant part of whether you have enough income to cover all your expenses when you retire.

3 – Emergency fund

According to the financial services company Bankrate, 60 percent of Americans would not be able to cover an unexpected $1,000 expense that comes up. And unexpected expenses don’t suddenly stop popping up just because you’ve retired.

In fact, unexpected expenses can be even more devastating in retirement because you don’t have the same earning potential to deal with any money you have to borrow to handle the matter. Definitely make sure you have an emergency fund that will cover car repairs, major household expenses such as new appliances or a leaky roof, and even medical costs that insurance won’t fully cover.

4 – Employer Savings Plans

Are you actively participating in employer savings plans?

If you’re self-employed, or your employer doesn’t offer a 401(k)-type plan, then contribute to an IRA.

How Much Money Should You Set Aside for Retirement?

In addition to considering what lifestyle you have in mind and what funding that looks like, it helps to calibrate your retirement savings goal using one or several of the retirement calculator approaches.

The 25x Rule to Calculate Retirement Needs

According to How to Save for Retirement by Forbes,

“… you can create a more personalized goal for yourself using the 25x rule. Estimate your annual expenses in retirement and multiply that figure by 25. If you think your annual expenses will be $50,000, for example, the 25x rule suggests you’d need a total of $1.25 million saved to retire without having to worry about depleting your nest egg early.

The theory behind this rule of thumb is the 4% safe withdrawal rate. The 4% rule suggests that over a 30-year retirement, you can safely withdraw 4% of your portfolio in year one of retirement, then keep withdrawing the same dollar amount, adjusted for inflation each year, to prevent running through your savings early.”

Be sure to pressure-check what that 4% yearly withdrawal rate looks like based on your wished-for lifestyle.

Save 10% to 15% of Pretax Income

In How to Save for Retirement, NerdWallet recommends another approach:

“Aim to save at least 10% to 15% of your pretax income. That’s what most experts recommend, and it’s a good starting point for your own calculations.”

Here are some interesting NerdWallet recommendations based on Fidelity Investments‘ guidance on levels of retirement savings over your career.

“… at age 30 you should have at least your annual salary saved. By the time you turn 40 years old, you should have saved three times your salary. At age 50, you should have six times what you earn annually saved for retirement. By the time you hit age 60, the goal is to have eight times your salary saved – and it should reach 10 times your salary by age 67.”

Finally, wisdom from Investopedia in Saving for Retirement: The Quest for Success,

“According to some financial planning experts, you will need to save enough so that your retirement income is in the range of 70% to 80% of your pre-retirement income. You will need a higher percentage if you plan to improve your standard of living. If you have more expenses in retirement than before retirement, your retirement income may have to be more than your pre-retirement income.”

These two resources offer interesting scenarios:

>> The Smart Asset Retirement Calculator

>> How to save for retirement from Nerdwallet

Review Your Retirement Savings Goal on a Yearly Basis

The last important step is to regularly review your retirement savings goal to make sure you are on track, consider increasing your savings rate, and make any other modifications to ensure you meet your goal.

If you need perspective on investing to meet your retirement goal – how to do it, why do it, when to do it – don’t hesitate to reach out to Pendragon Capital.

Thanks for reading.

Subscribe to Pendragon's Newsletter

Image credit: The Sweet Relaxations of an Ironmonger Retired from the Business of Men and Andirons, Honoré-Victorin Daumier, French (Marseille, France 1808-1879 Valmondois, France), Harvard Art Museum

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.