In the past week or so, the markets, I suggest, have begun to question the prevailing conventional wisdom that inflation will remain persistently high and that the economy is likely to fall into a deep recession. This article explores why.

>> To subscribe to this monthly newsletter, click on Subscribe!

Commodity Prices & Payroll Suggest Moderating Inflation

Commodity prices have fallen sharply.

Inventories, in some instances, especially in retail seem to be building as supply chains work through their bottlenecks and demand has softened.

In the most recent payroll report, the labor market seems to be holding up with some reduction in the pace of wage increases.

By looking at the markets, the expectation could be that inflation is moderating and the economy is slowing but perhaps not as dramatically as previously thought.

Interest Rates & Inflation Expectations

Long-Term Interest Rates Not Collapsing

Long-term interest rates have declined which may be evidence of lower inflation expectations and that the economy is slowing. Furthermore, long-term rates are also not collapsing which may mean that the slowdown could be milder than thought.

Short-Term Interest Rates Not As High as Expected

Rates at the short-end of the curve have gone up but seem to not be as high as one would have expected if the markets believed that the Fed has to relentlessly raise rates to fight inflation.

Stocks Don’t Neatly Follow the Economy

The market’s mood can change quickly so it may be too early to know for sure where inflation and the economy are going. It’s important for investors to remember that stocks do not necessarily neatly follow the direction of the economy.

Typically, the stock market will lead the economy lower and reach bottom ahead of the economy. While the economy certainly is a major factor in company profitability, there are other factors at play.

How Will Inflation Affect the Bottom Line?

We are not certain how inflation will impact the “bottom line”.

Are companies able to pass on higher costs? We will find out more over the next few weeks as firms report their second-quarter earnings.

Street analysts seem to have just begun to lower estimates. They may be late in this but shares have been significantly marked down based on macro forces. There may be a greater degree of company-specific profit pictures.

In any case, volatility around earnings is likely to be high and requires a bottom-up approach to evaluating whether profits are stable.

Investing Success: Be Where The Puck Will Be

There is a saying in hockey that goes something like,

“Success is not getting to the puck. Success is getting to where the puck will be.”

The same holds for investing.

The economic data we receive and the earnings reports we read tell us about what happened and not what is going to happen. There is a tendency for investors to move in a herd, chasing the most recent data and extrapolating it into the future. It’s understandable that this behavior exists.

First, there is safety in numbers. Being part of a group is often the safest for one’s career.

Second, the future is unknown. One needs something to go by and you go with the data you have. Once a herd gets moving, the momentum builds upon itself.

Investors who can grab on to a strong momentum trade can do very well and betting against the trend can be painful to your wallet.

However, markets tend to overshoot. A trend can pick up so many followers that eventually there is no one left to join the parade. It is all about positioning. If everyone is bearish, then there is a setup for a bullish rally.

Be a Contrarian Investor

This is where a contrarian investor can do well. It is holding cash, going to where the puck will be, and then buying when everyone has already sold. It takes disciple and patience. We may be in such a period now.

>> See The Lonely Life of a Contrarian Investor

Inflation, Recession, and Plenty of Pessimism

The inflation and recession drums have been beating loudly over the past six months. Pessimism abounds. The major stock indices are down about 20% but many individual stocks are down 40% to 70%. Are investors way too bearish and positioned as such?

When pessimism is at its highest, any good news can cause a strong inverse and opposite move as the bears scramble to re-position with buy orders.

What I’ve described is on a big-picture basis but the same happens in sectors and with individual stocks.

Recently investors sold short about 40% of the biotech ETF, XBI’s shares outstanding. The stock bottomed around $63 in mid-June and now is $84.43 That’s a 34% rise in less than a month.

When the Russian invasion of Ukraine started, oil prices soared. More and more analysts came out with ever higher price targets, some even $250 or $300 per barrel. Since those analyst calls, oil is down from $122 per barrel to $104. The energy stock index, XLE is down from $92 to $71.

Are You Questioning Persistent High Inflation and Deep Recession Fears?

Investing in the midst of inflationary pressures and concerns about recession is challenging. That’s when having a trusted financial investment advisor can be beneficial. In the meantime, the lessons are:

- Be careful not to stay in a trend too long, and

- Look for when investors are over-positioned in one direction and maybe go against it.

Please don’t hesitate to reach out with questions.

Thanks for reading.

>> Download the July/August 2022 Newsletter <<

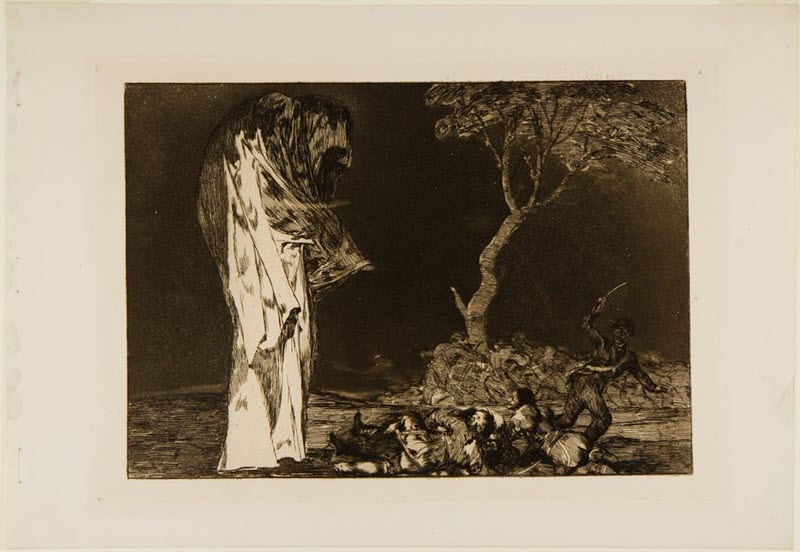

Image Credit: Francisco José de Goya y Lucientes, Spanish (Fuendetodos 1746 – 1828 Bordeaux), Do Not Lose Honor Through Fear: Folly of Fear, 18th-19th century, Harvard Museum

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.