Investor concerns over the recent underperformance of technology stocks have raised questions about concentration risk and the broader market.

Strong returns among artificial intelligence stocks have supported portfolios over the past few years. At the same time, they have raised questions about the sustainability of the market rally. Concerns for tech stocks primarily include concentration risk, frothy valuations, and comparisons to prior bubbles.

How can investors maintain a long-term perspective and stay balanced amid these market dynamics?

The Market Rally has Broadened Beyond Technology

When it comes to tech stocks, it’s important to separate their performance from their impact on the broader market.

While these companies have shown strong growth, this has also led to higher valuations, creating opportunities and challenges for investors. History shows that leadership among both stocks and sectors tends to rotate over time as investor expectations shift. That suggests that maintaining exposure across different parts of the market is the best way to maintain portfolio balance.

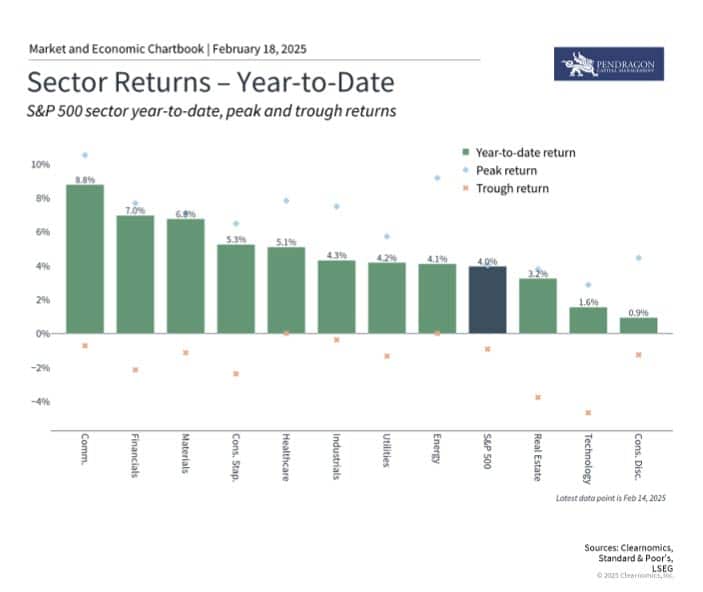

Tech vs. Financials, Materials, and Consumer Staples

The Information Technology and Consumer Discretionary sectors have lagged behind the broader market in the early parts of 2025. This is a reversal of the trend since late 2022 when these sectors led the market alongside Communication Services. Realize that they include some of the largest technology companies!

Instead, other sectors have contributed positively, including Financials, Materials, and Consumer Staples.

Why has this happened? Three factors have driven the rotation:

- Concerns over frothy valuations,

- Higher-than-expected interest rates, and

- Uncertainty around AI investments by large tech companies.

The price-to-earnings ratio for the S&P 500 is now 22x. This is approaching dot-com bubble peaks. It’s also 27.7x for the Information Technology sector. Importantly, spending on AI infrastructure continues to increase at a rapid rate, and global competition has risen as well.

The fact that other sectors have rallied is a positive sign for many investors who have hoped for a broadening of performance.

While it’s still early in the year, this wider market participation suggests a healthier environment. Why? Because growth is not concentrated in just a few areas. It highlights that investors are searching for more attractive valuations across different parts of the market, after 2.5 years of strong returns.

Tech and Risk

Technology stocks can be attractive investments but are naturally volatile and sensitive to the economic environment.

- In 2022, the Nasdaq and S&P 500 Information Technology sector each fell about 35% before rebounding quickly.

- Similar pullbacks occurred in 2018 and 2020 as well.

- This is a recurring phenomenon (e.g., most famously the dotcom bust that began in 2000).

However, many other periods experienced similar trends. For instance, the 1960s technology boom centered around a group of popular technology and electronics stocks. These companies traded at high valuations before experiencing significant declines in the 1970s market downturn.

In the long run, technological breakthroughs – whether semiconductors, information technology, or large language models – benefit many types of companies and sectors. The digital revolution that accelerated in the 1990s is still evolving today.

For long-term investors, it’s important to maintain a balanced approach that takes advantage of these broader trends, rather than attempting to time each market rotation.

>> See Why Staying Invested Is So Important For the Long Run

Concentration Risk Remains a Concern

Stock market sectors are also important in how they affect the broader market. The composition of major market indices has shifted over the past decade. Technology-related companies dominate the S&P 500 -more specifically companies sometimes known as the Magnificent 7: Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Tesla.

The fact that a small group of stocks has an outsized impact on the overall stock market may feel unsustainable to many investors. This is a form of “concentration risk,” or the potential vulnerability from too much exposure to a single sector, asset class, or small group of investments. Many investors may unintentionally find themselves with increased exposure to certain sectors as dominant stocks in major indices grow larger.

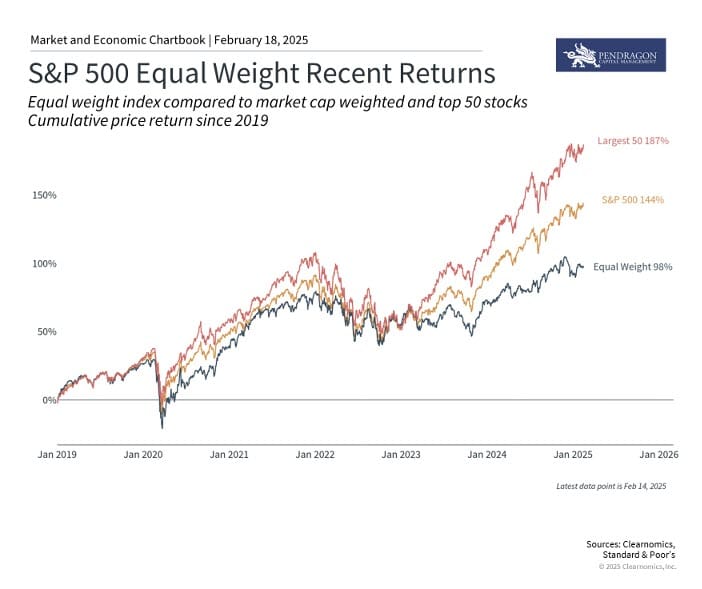

Weightings Based on Size vs. Each Weight Per Individual Stock

Perhaps the simplest way to visualize this is to compare the standard S&P 500 index, which places a weight on each stock based on size, to one that gives an equal weight to each stock. The former provides a more accurate sense of the composition of the stock market, i.e., where the dollars are. Using equal weightings helps investors to benefit from a broader base of companies and their performance, regardless of their size.

Just as diversification helps protect against downside risk, concentration can amplify both gains and losses. In this environment, investors may need to conduct regular monitoring and rebalancing of portfolios to maintain desired risk levels. This makes it crucial for investors to regularly review their portfolio, ideally with a trusted advisor who understands your broader financial goals.

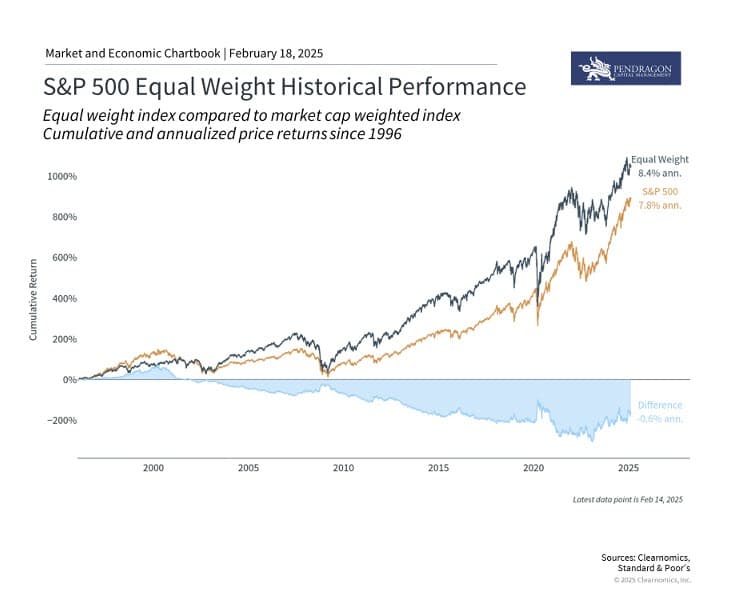

In the Long Run, Many Sectors Contribute to Portfolio Returns

While a concentrated set of tech stocks has driven markets in recent years, it’s important to know that this has not always been the case. History shows that over longer periods, many stocks have contributed to the success of the S&P 500, as shown in the accompanying chart.

In fact, it’s also not the case that large companies always dominate stock market returns. For much of the history of the stock market, investors considered the largest companies, known as “blue chips,” the most boring, perhaps serving as a source of stable dividends.

Mitigate Risk With a Broader View of Market Opportunities

So, while there continues to be investor enthusiasm for artificial intelligence stocks, investors should maintain a broader view of market opportunities. If AI trends are as impactful as many hope, the economic effects could be more extensive and longer lasting than previous technological revolutions. This fact benefits balanced investors.

Managing Concentration Risk

The bottom line? Despite concerns about the recent weakness in large tech stocks, long-term investors should remain disciplined to take advantage of all parts of the market.

Thanks for reading! Don’t hesitate to reach out if you would like to further discuss the markets.

>> Schedule Your Free Investor Consultation <<

Image credit: To Rise and to Fall, plate 56 from Los Caprichos. Francisco José de Goya y Lucientes, Clarence Buckingham Collection, Art Institute of Chicago

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved.

The information contained herein has been obtained from sources believed to be reliable. It is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice.

All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally. Do not construe these as a recommendation to buy, sell, or hold the company’s stock.

Do not construe predictions, forecasts, and estimates for any and all markets as recommendations to buy, sell, or hold any security. This includes mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc.. They constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy.

Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.