Would you combine baseball and investing in one sentence? We would, and here’s why.

I invite you to reach out with your financial questions so we can discuss them. I am using new retirement planning tools to assist clients in framing their investment path to retirement.

What Makes Baseball Stand Out? Focus on the Long Run

“Opening Day” for baseball is here.

Despite efforts like the Designated Hitter and the pitch clock to speed up the game, baseball remains a metaphor for the calm, long summer days. Baseball is a 162-game season and if your team hopes to make it to the playoffs in the Fall, you have to focus on the long run.

Investing: All About the Long Season

Sound familiar? Yup, investing, like baseball, is all about the long season. There are many paths to get you to your financial goals, all take steadiness, focus, and planning.

>> See Why Staying Invested Is So Important For the Long Run

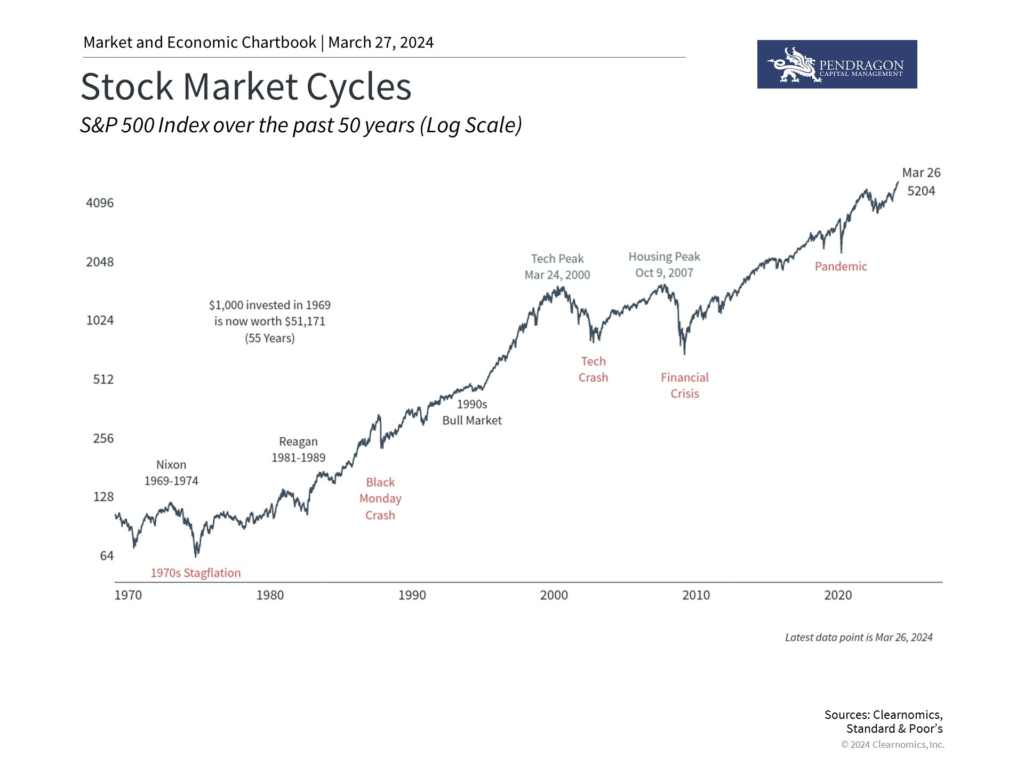

The stock market has had one of the strongest 1st quarter starts.

From the end of 2023 through halfway into the 1st quarter of 2024 it was the mega (or super-mega) caps stocks that led the charge. However, since mid-February, the rally has broadened out with the equal-weighted S&P500 and small-cap indices joining the party. This is a healthy development and might reflect an overall positive outlook for the broad economy.

I’ve included a chart of the S&P500 over the past 50 years.

As you can see, there were all sorts of economic difficulties – inflation, Black Monday, The Tech Wreck, and The Great Financial Crisis, to name a few.

Two Observations About the Market

Notwithstanding all of them, the market moved higher. That’s observation one.

Observation two is that the market frequently makes new highs.

This past week a chorus of pundits called a top after the first quarter’s stellar performance. If investors sold at every new high, they would have missed out on the next new high.

Just as Bear Markets can be worse than expected, Bull Markets can be better than expected.

Baseball and Investing Share a Longterm View

While we watch our investments grow, here is a list of some popular baseball books to read through the season from Six Great Books About Baseball in the Economist (subscription required):

>> Moneyball

>> Ball Four

To that list, I add Sparky Lyle’s The Bronx Zoo about the Yankees in the 1970s.

Baseball and Investing: More Alike Than Different

I invite you to reach out with your financial questions so we can discuss them, I am using new retirement planning tools to assist clients in framing their investment path to retirement.

Thanks for reading.

>> Schedule Your Free Investor Consultation <<

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investing involves risk.

Image Credit: The Miriam and Ira D. Wallach Division of Art, Prints and Photographs: Print Collection, The New York Public Library. “Baseball.” The New York Public Library Digital Collections. 1865 – 1899. https://digitalcollections.nypl.org/items/510d47db-ca6b-a3d9-e040-e00a18064a99