As year-end 2020 approaches, here are investment observations to consider. This is a good time of year to assess your financial goals, investments, and personal situations. In addition, it’s an ideal time to speak with your financial advisor to see what changes might be needed to keep your finances on track.

Below, you’ll find the November/December BrokerageSelect Newsletter which summarizes current market trends while highlighting the kind of innovative out-of-the-box thinking that Pendragon Capital Management specializes in.

Perspective on the Stock Market: November/December 2020

Looking back on a year to both remember and forget, some investment observations are worth examining.

1. The futility of forecasting

The first is the futility of forecasting. We are bombarded with market analysts, pundits, and prognosticators.

In January, we were not hearing choruses warning of a furiously fast Covid-led Bear market happening just 3 months into the year. Then at the bottom in late-March, the Bears were in full force, missing a recovery in stock prices.

Investment Tip #1

Making money in the stock market requires patience, a long-term perspective, and a sense

of knowing and valuing what you are buying. Successful investors avoid panic at bottoms and euphoria at tops.

All this is easier said than done.

2. Intra-year declines in stock prices

Yesterday, I noticed a chart courtesy of Barry Ritholtz that illustrated the 28 years that had the largest intra-year declines in stock prices and how the market ended in each of those years.

- The end results in years where markets fell at some point were all over the place.

- Some years ended with big gains and in some years the market stayed down.

- At the bottom this year the S&P500 was down about 34%.

- More often than not (16 of 28 years) stocks were down at least 19% at some point but closed the year down less than 10%.

- In five of the years, the S&P500 ended with double-digit gains.

Perhaps the reason for the rebounds is government intervention.

More specifically, in 2020 Congress and the Federal Reserve injected more money into the system than they did during the 2008 Financial Crisis.

Investment Tip #2:

The bottom line is that sticking with your long-term financial strategy and not reacting to short-term news flow is the best way to stay the course.

Re-balancing and re-positioning are also helpful to manage risk, buying somewhat that is low, and selling somewhat that is high.

3. The effect of the Pandemic

There are other observations to consider. The pandemic has pulled demand forward for many companies which means that some stocks may be over-valued.

Having said that, other companies that have benefited from Covid may now be a part of new and lasting trends just beginning long revenue runways. Investors will need to think about this differentiation.

4. An effective vaccination program

The final thought I’d like to leave for the year is that the large valuation gap between those companies seemingly benefitting from Covid and those that were negatively impacted will narrow if we have an effective vaccination program.

Similarly, parts of the world, like the US, have outperformed places like Europe and Emerging Markets. If the planet resumes to normal, markets in these areas could catch up.

Out Of The Box

2020 has been a “different” year to say the least.

As such, for the last Out Of The Box section of the year, I wanted to broaden the discussion beyond investments. This period of upheaval and uncertainty promises to continue long after Covid is behind us.

Working with a coach

Changes we never could have predicted — and a good number of which we would not have chosen — have caused many of us to pause and reflect upon our values, goals, and dreams.

If you are finding yourself delving into the questions of what you truly want to do, have, and be, you are in good company — and you may benefit from the increasingly popular practice of working with a coach.

Meet Wendy C. Schult

Wendy C. Schult, The Authenticity Coach and founder of Keys to Authenticity LLC, helps high achievers explore, vet, and clarify their own definition of success, figure out what is getting in the way (such as beliefs and habits that no longer serve), and create tactical,

practical plans to make those dreams a reality.

Wendy has joined the BrokerageSelect team and brings a variety of expertise that we will incorporate into our practice.

A Certified Professional Coach (CPC), credentialed by the International Coach Federation (ICF), Wendy draws upon her 23-year career at Ayco, the financial counseling arm of Goldman Sachs.

She worked as a trusted wealth advisor to her clients and C-suite and other senior executives at Fortune 500 companies, to create and implement all aspects of their long-term financial plans. Wendy ultimately served as Senior Vice President, heading one of the largest regions of the firm.

You can learn more about working with Wendy as a coach at www.keystoauthenticity.com. She invites you to contact her to schedule a complimentary conversation.

Thanks for reading.

The Pendragon Capital Management Team

Click to Download the 2020 Nov/Dec Newsletter

Note: This blog article is intended for general informational purposes only. Nothing in it should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

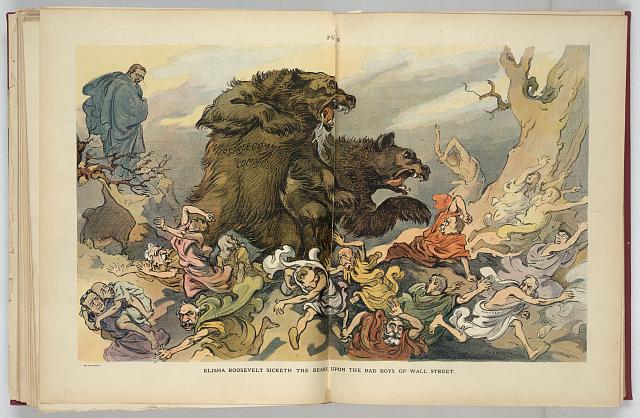

Image Credit: Elisha Roosevelt sicketh the bears upon the bad boys of Wall Street. Reproduction Number: LC-DIG-ppmsca-26165 (digital file from original print) LC-USZ62-114678 (b&w film copy neg.) Call Number: Illus. in AP101.P7 1907 (Case X) [P&P]